Your Real Estate Market Update From your Reid Realtors team

Happy New Year! We are sharing some highlights from the real estate market in 2024 and a advice on navigating the market in 2025.

Below are a few highlights:

- Overall, the Memphis market was steady year over year finishing slightly above 2023 in sales.

- Sellers were most impacted as we saw houses sitting longer (higher days on market) and selling below asking price. While affordability is still a concern for buyers, the opportunity to find a better deal and take your time is appealing for some buyers.

- While the road ahead is uncertain, we are starting to see momentum and hopeful as we enter one of the hottest times of year in real estate – the Spring market.

Let’s dive into more numbers and insights below.

The Numbers

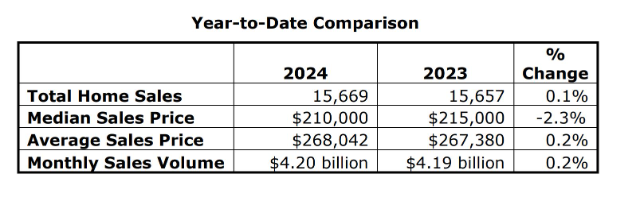

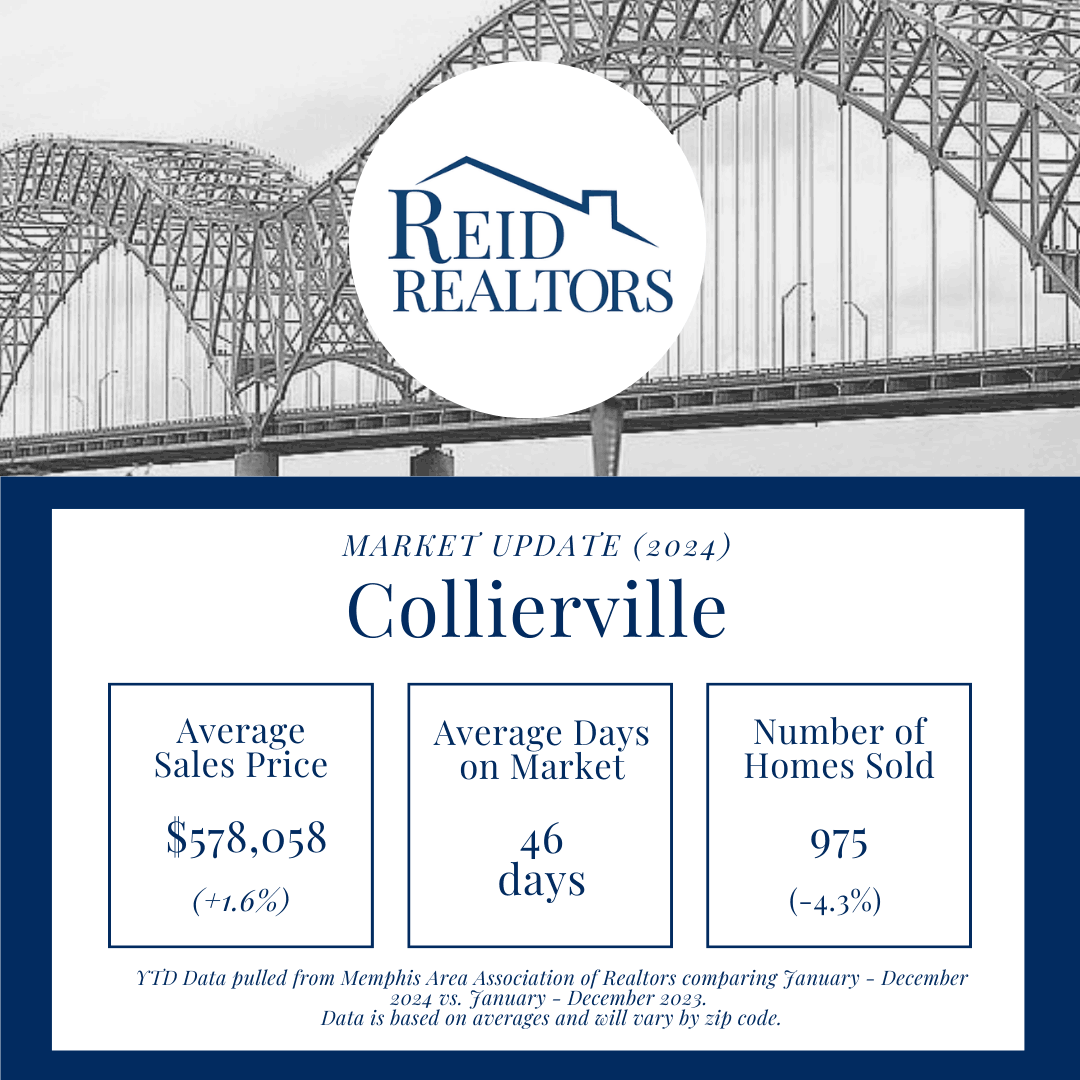

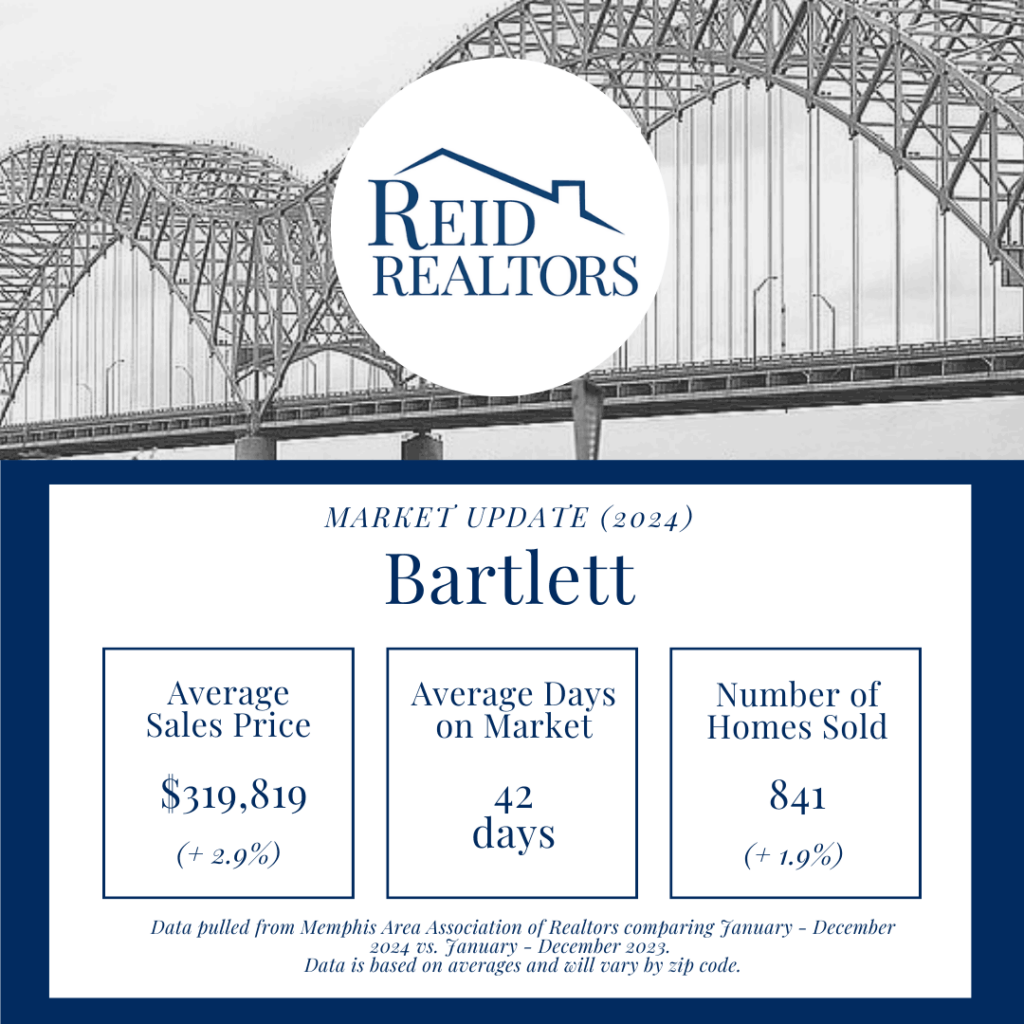

Below highlights overall themes and trends based on the Greater Memphis Area. For a detailed breakdown by suburb, visit our website below.

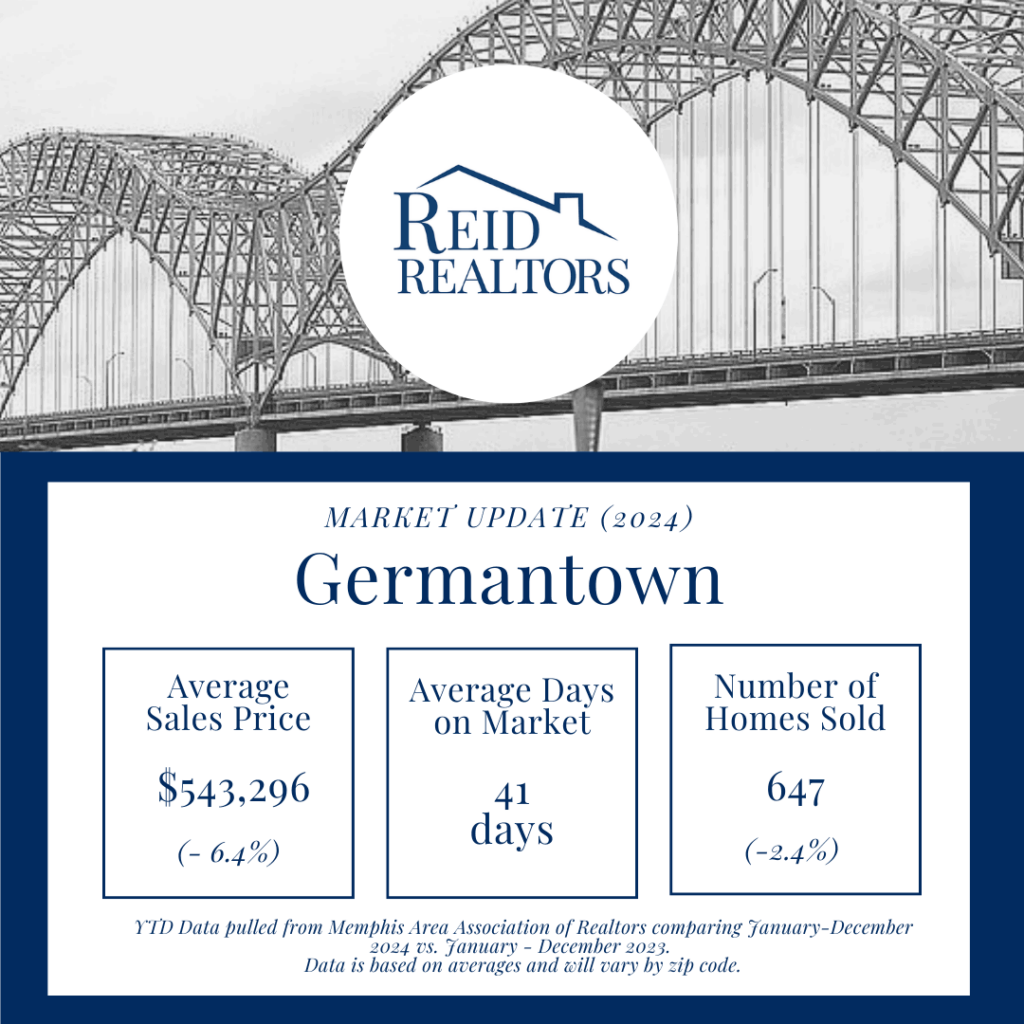

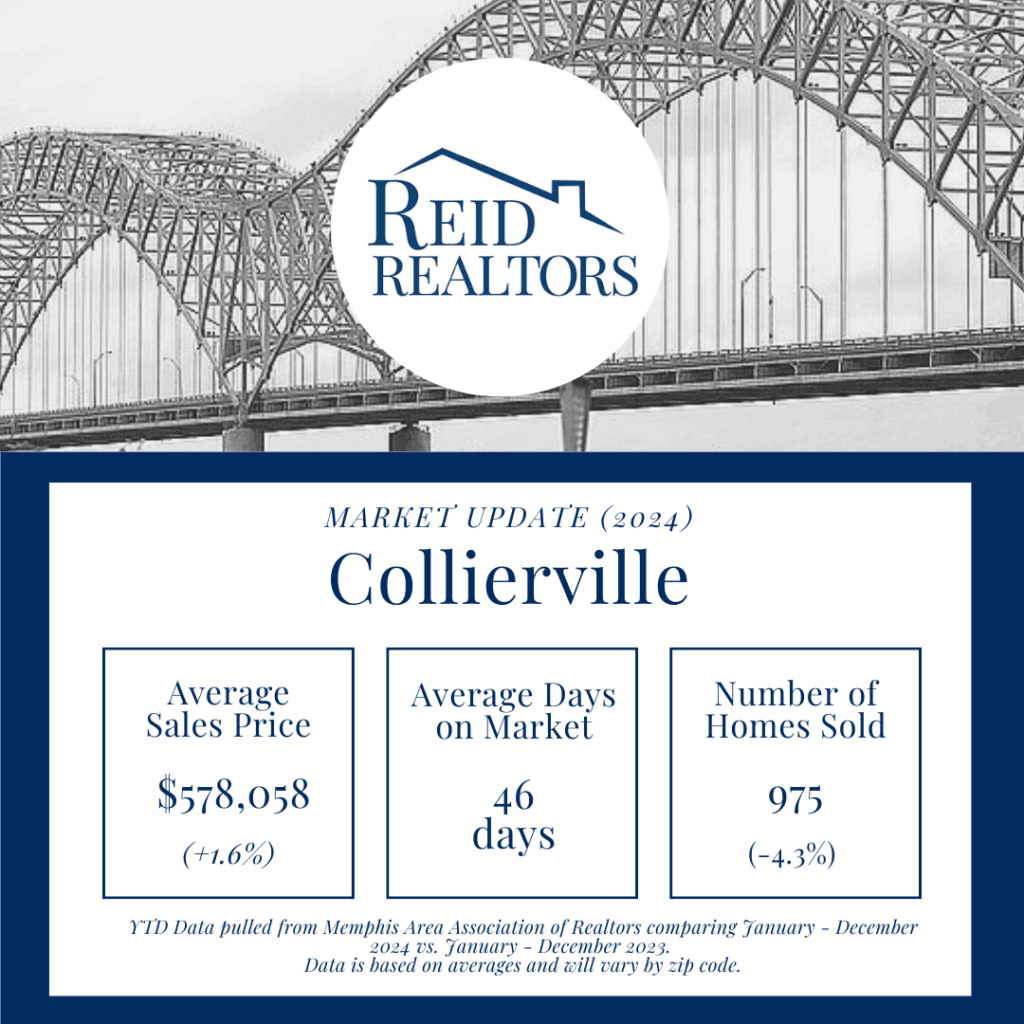

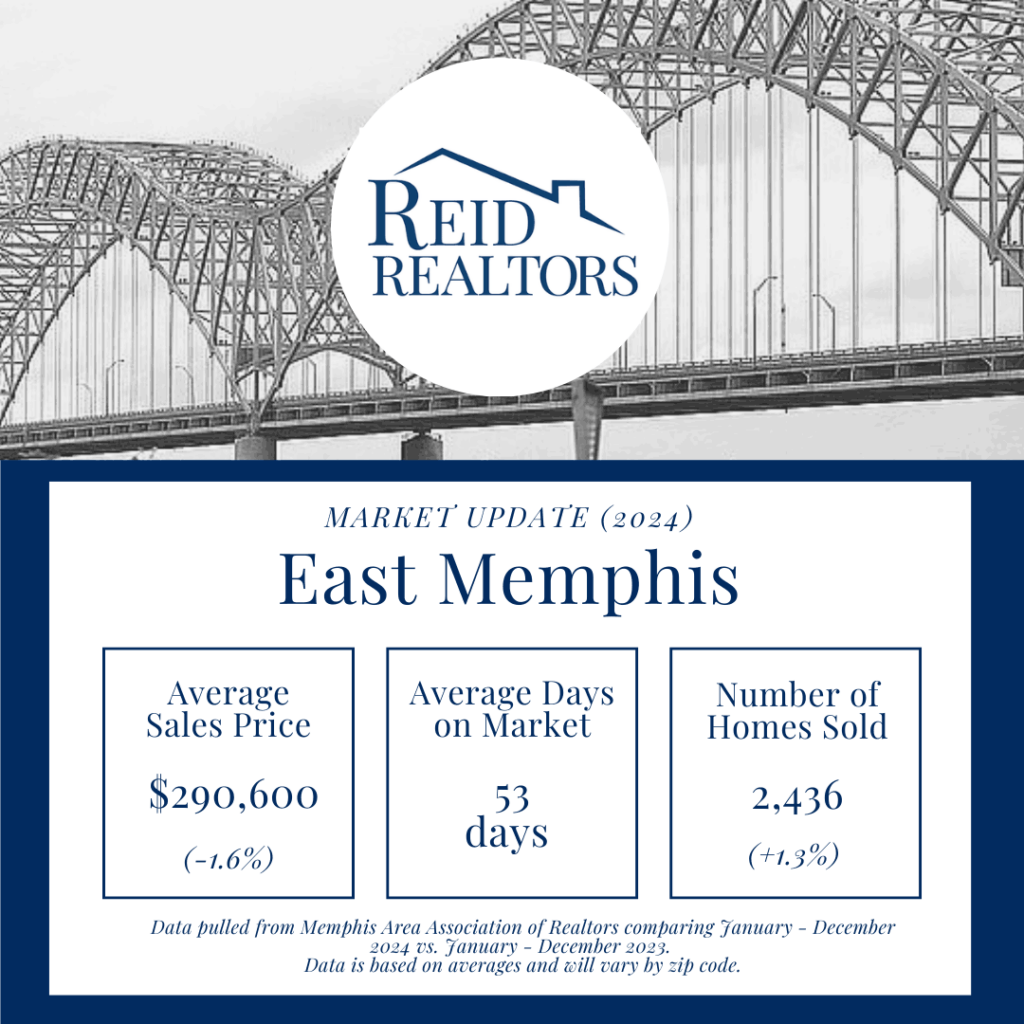

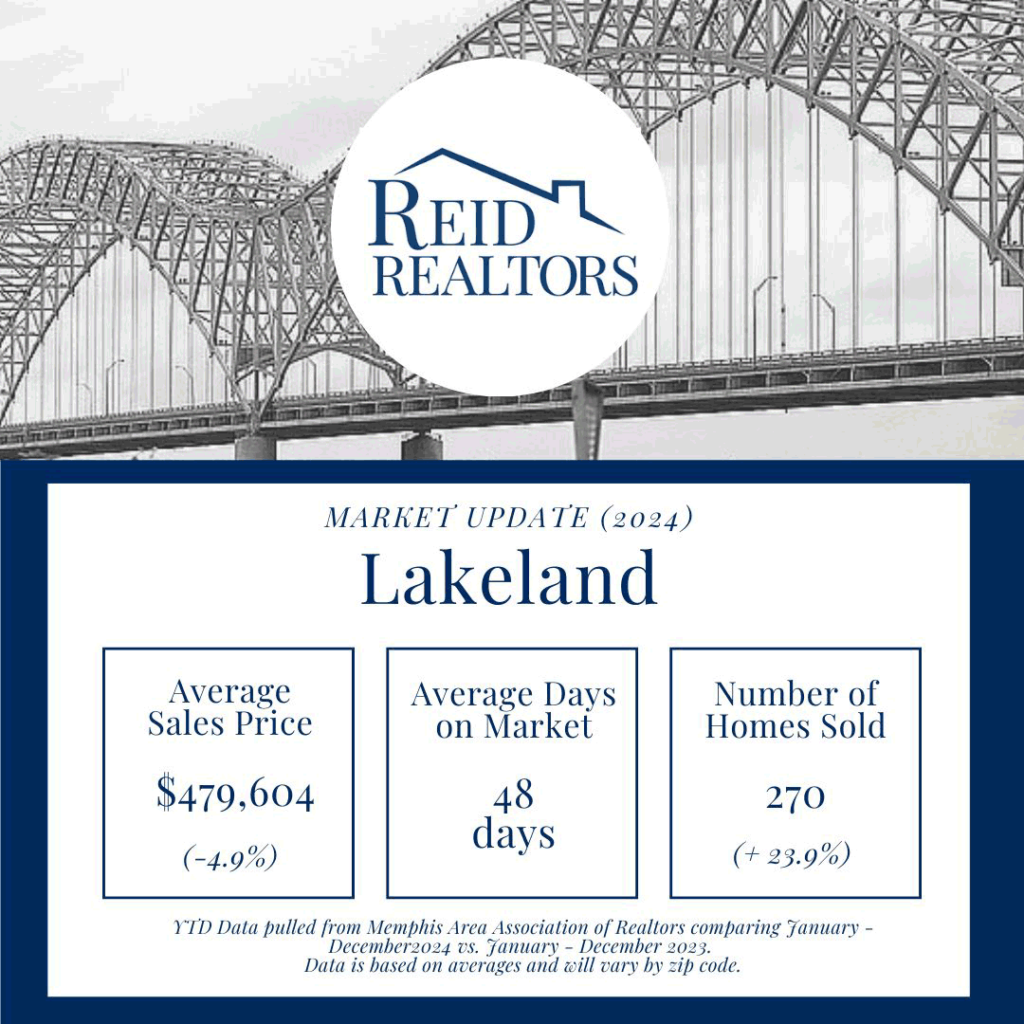

Numbers by Market:

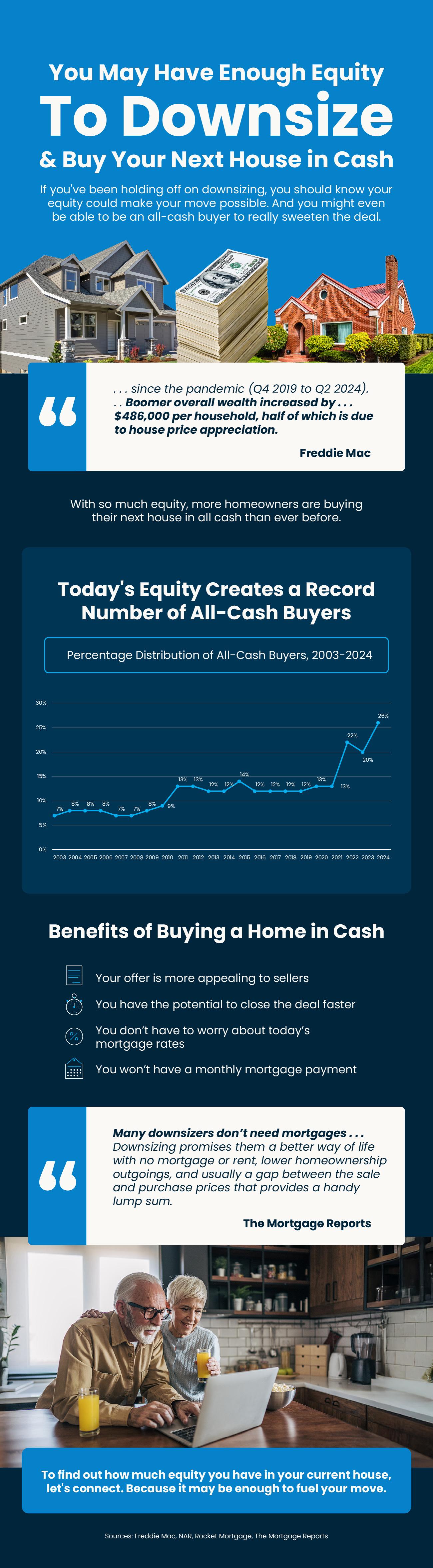

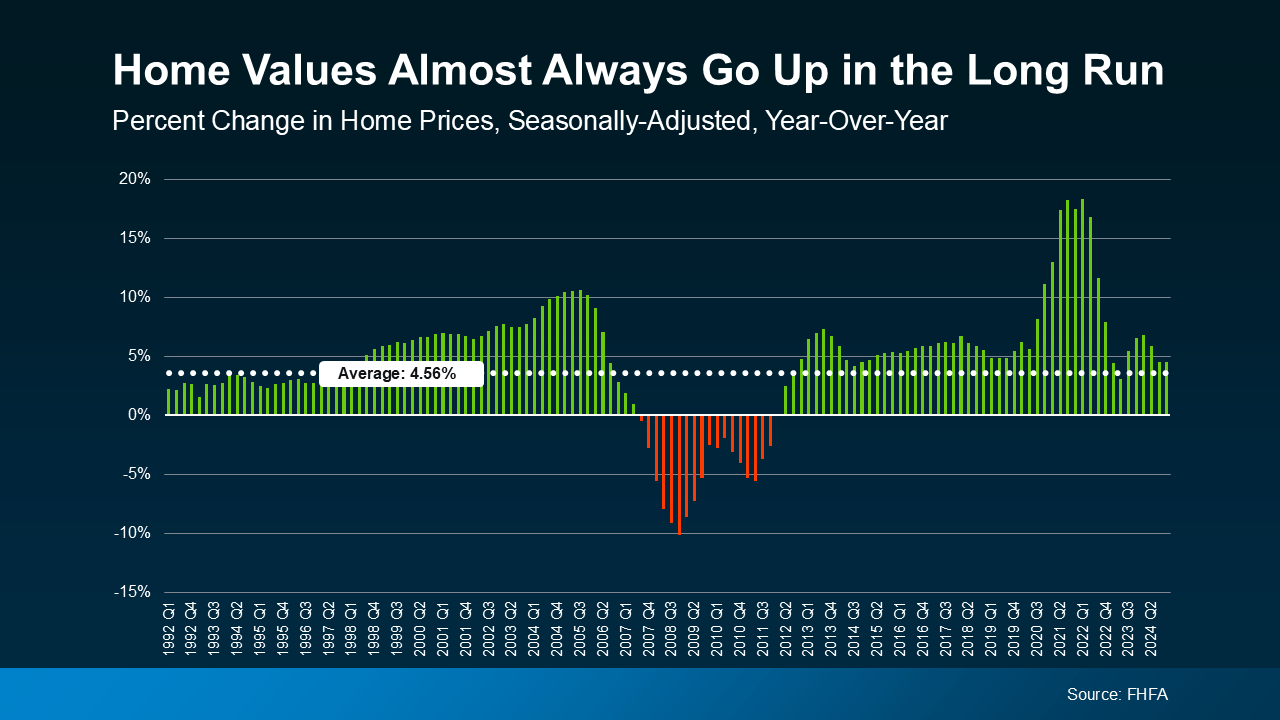

The year 2024 was a hard one for the real estate market with the lowest sales we’ve seen since 1995. However, the Memphis market remained steady at just .1% above 2023 in sales. Let’s dive into to some key takeaways from last year with advice on what to do this year if you’re considering a move.

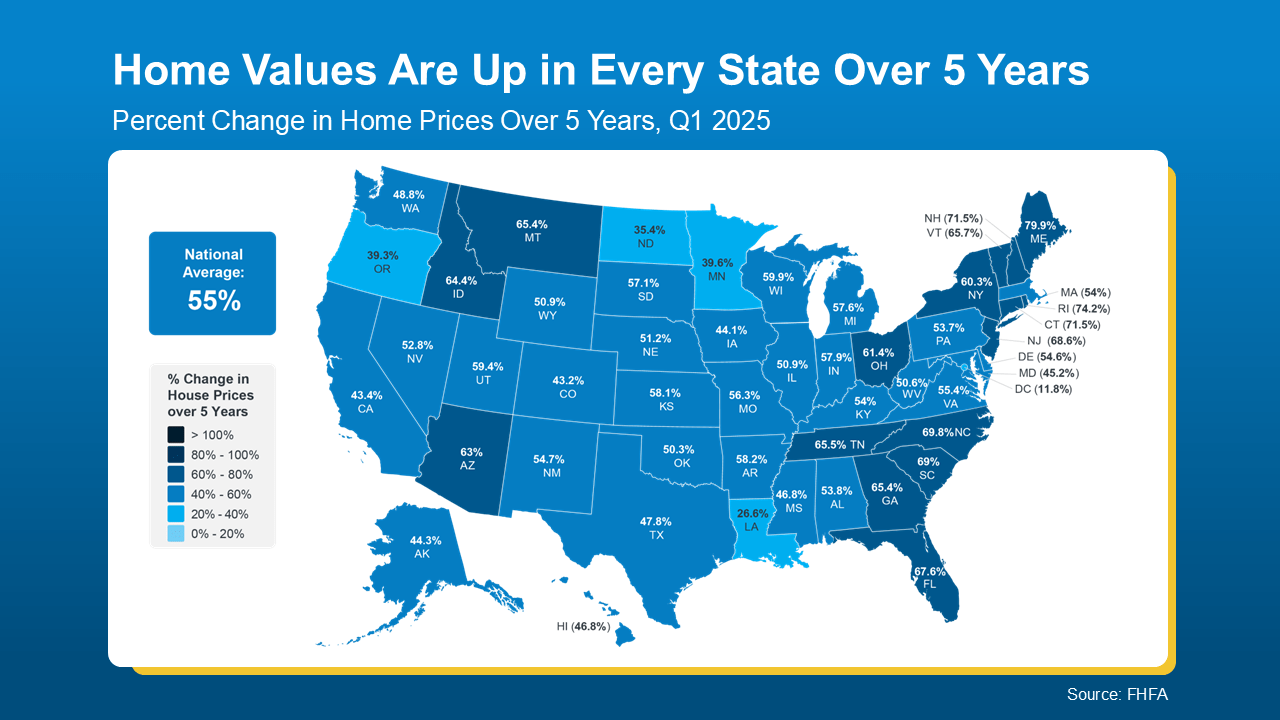

Memphis has proven to be a stable market .

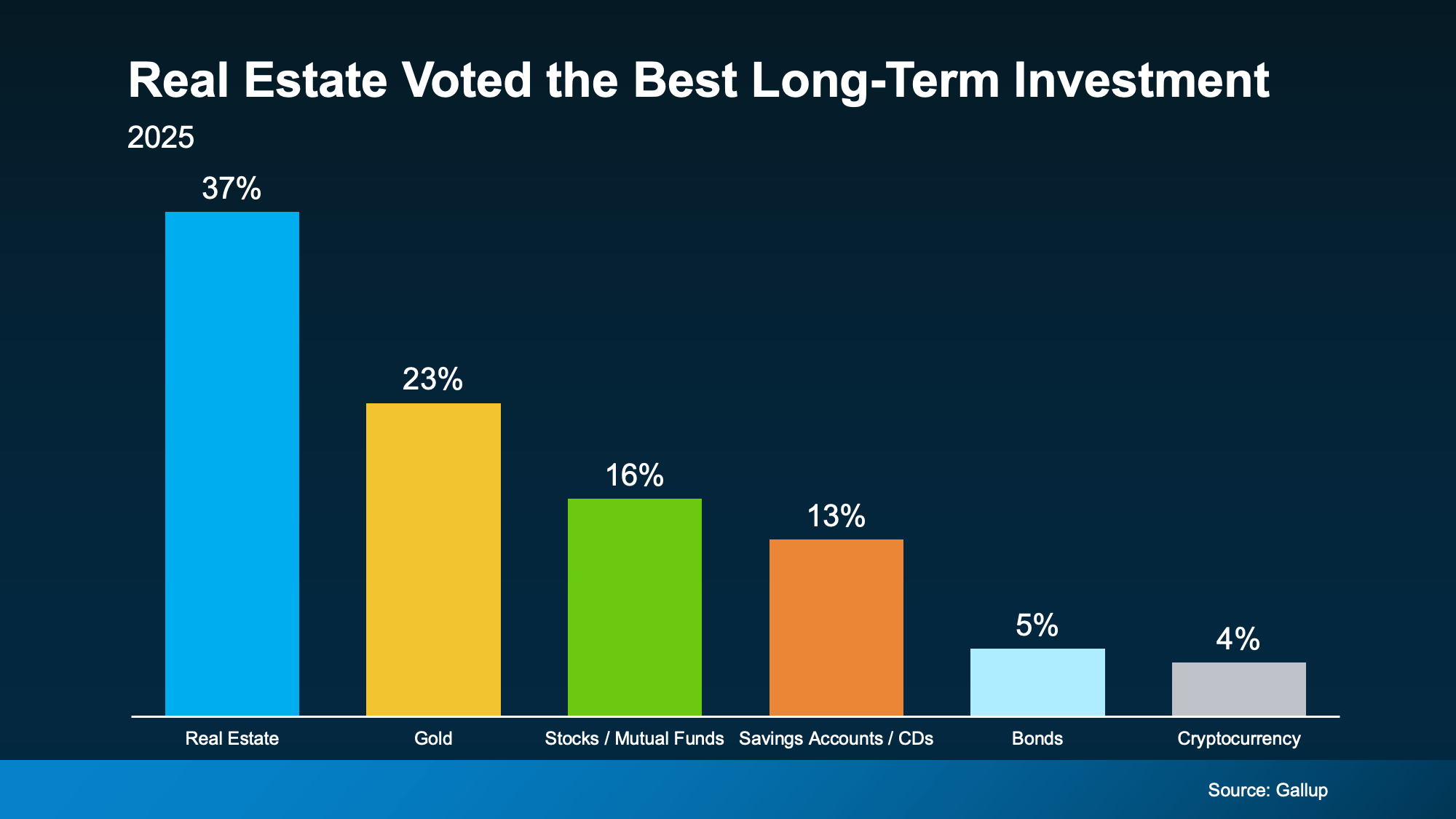

Memphians, there is hope! While our market sales remain steady year over year there are many other metropolitan areas where this is not the case. Memphis still remains a more affordable city to live and do life in and we are still seeing people relocate here for jobs and other reasons.

Our takeaway for you is to be prepared. The real estate market can change from day to day as we’ve seen in recent years. With a new year, new administration and policy changes, we don’t know what the future holds but we do know this… don’t wait until your circumstances change or the market changes to be ready. Let’s talk about a plan so that you are prepared when that time comes. Whether on the buying or selling side, there are things you can and should be thinking and doing if a move is on your radar in the coming years.

Sellers were impacted the most in 2024 whereas buyers had more opportunity.

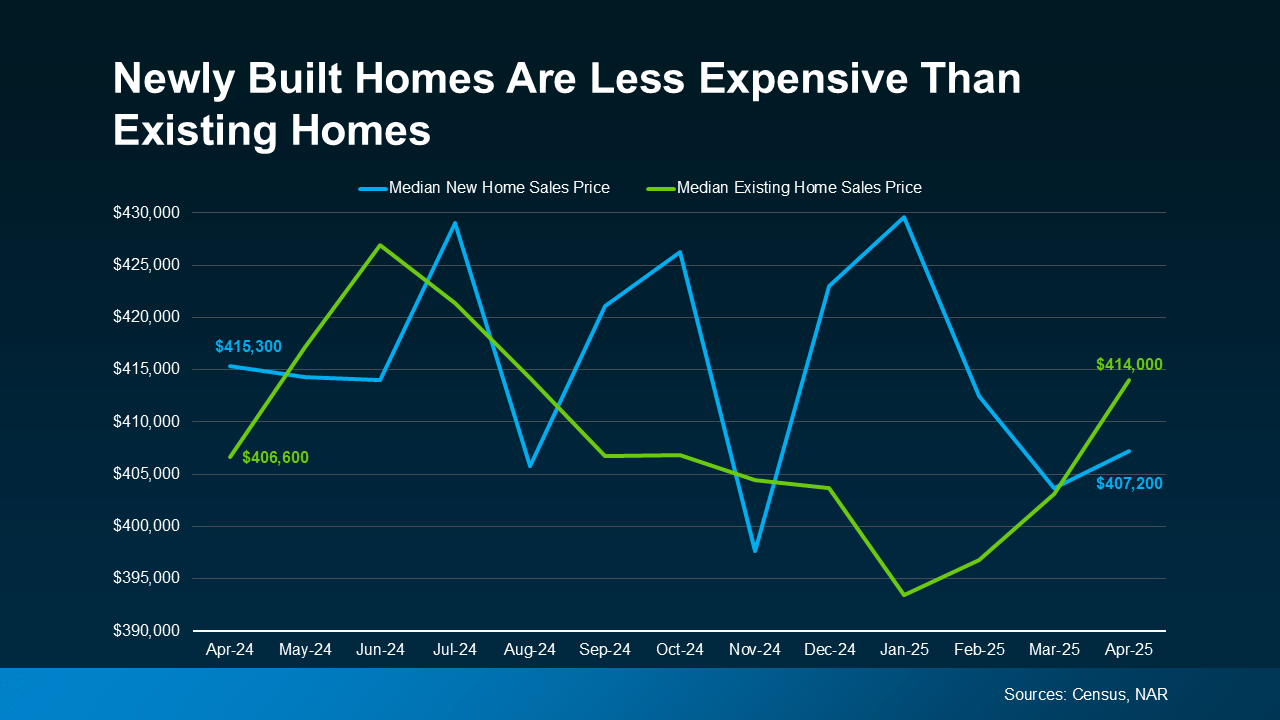

Two of the key indicators that show an impact on sellers last year are the median sales price and days on market.

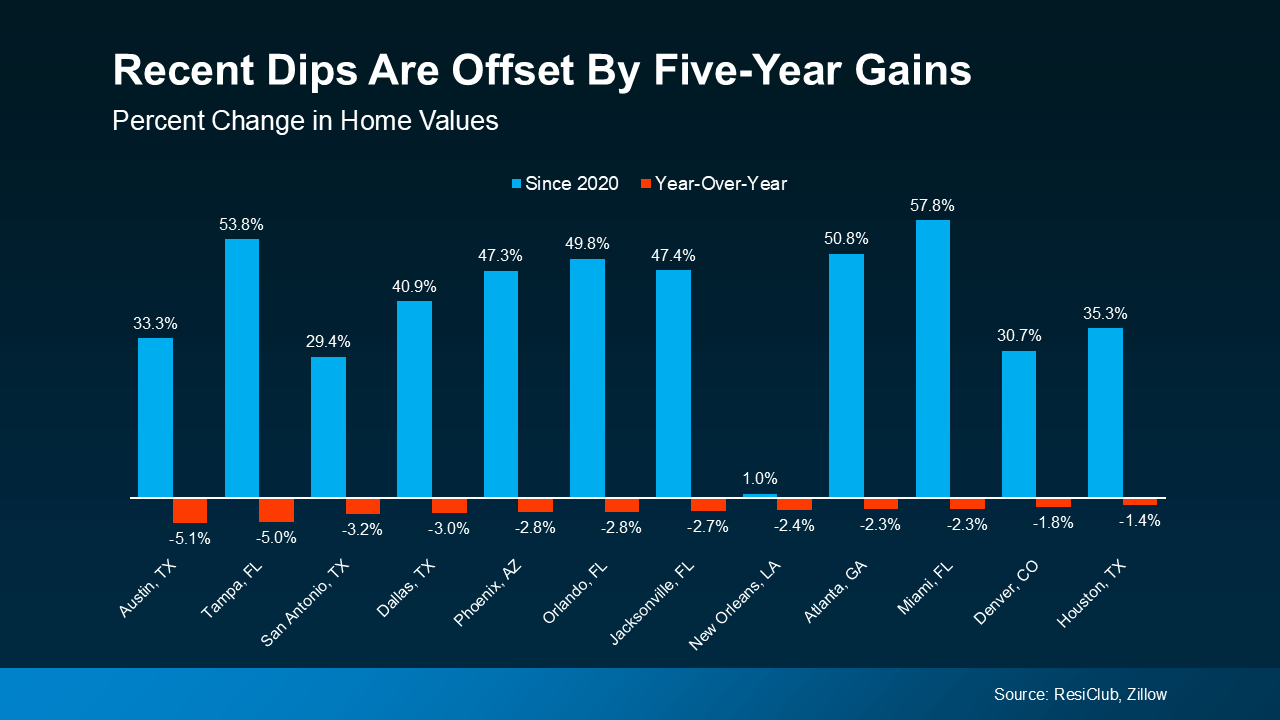

As noted in the chart above, the median sales price for Shelby County dipped at -2.3%. While this seems small, there are certain areas that are more highly impacted with a change as much as -14% in some areas. This is a vast contrast from what we’ve seen from 2020-2023.

Additionally, in Shelby County, days on market changed from 40 average days on market for 2023 to 51 average days on market in 2024. In some areas, average days on market in 2024 was as high as 62 days.

What this means for you (as a seller) this year is two things:

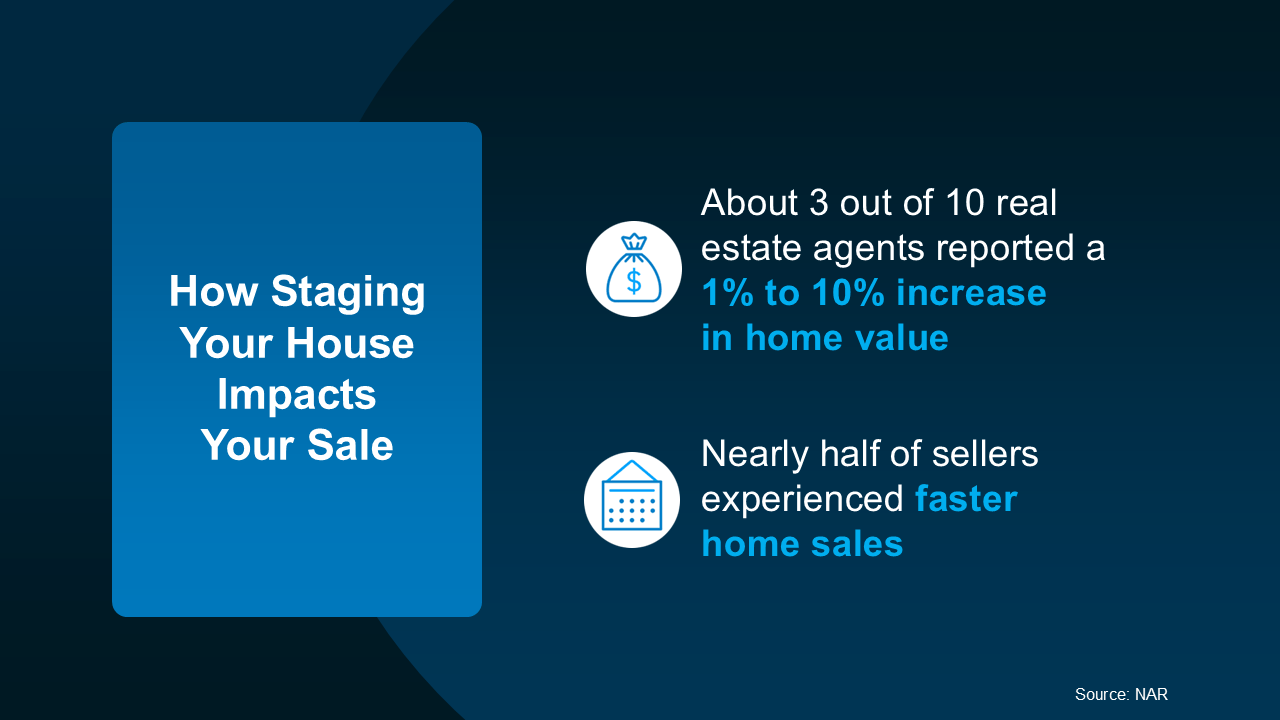

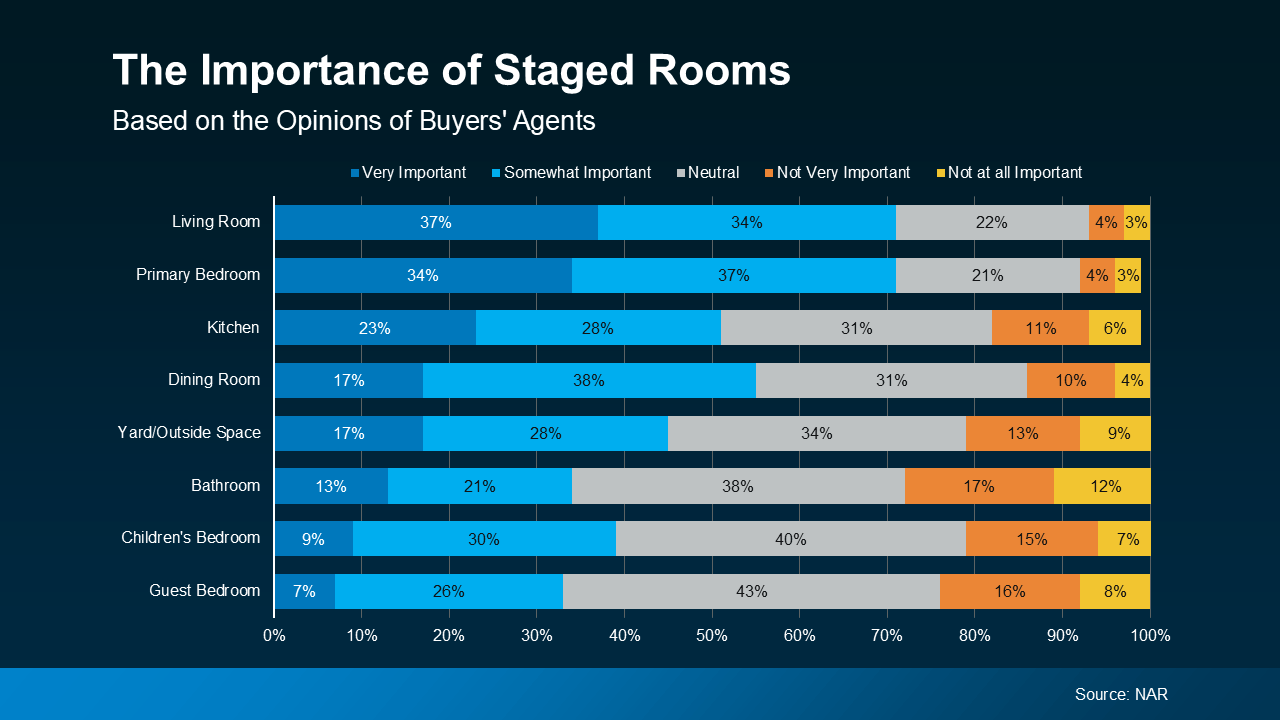

1) Pricing your home right is key to selling it in this market. Let your agent do thorough comps for you and start out at a price ready to move your home.

2) The homes that will move quicker are move-in ready. They are renovated, have fresh paint and other big ticket items taken care of. This requires time for you to prepare your home to go to market vs. waiting. Our approach to each home is different. Let us help you know what to do now to sell later.

Buyers had more opportunity last year in terms of getting a home below sales price and also more time to think and make a decision. However, our main takeaway for you this year is to not wait if you’re wanting to move. Let’s make sure you’re pre-approved, have your search criteria set up and don’t drag your feet on making an offer on something you love. Great homes are still moving quickly and if you love it, changes are someone else does too.

Seasonality still plays a role even in a slower market.

While the market may be slower, we know that real estate is cyclical and has historically seen higher sales in the Spring.

As we gear up for 2025, keep in mind that peak season is coming. The key is properly planning. Now is the time to prepare. This is where we come in and would love to come in and help you.

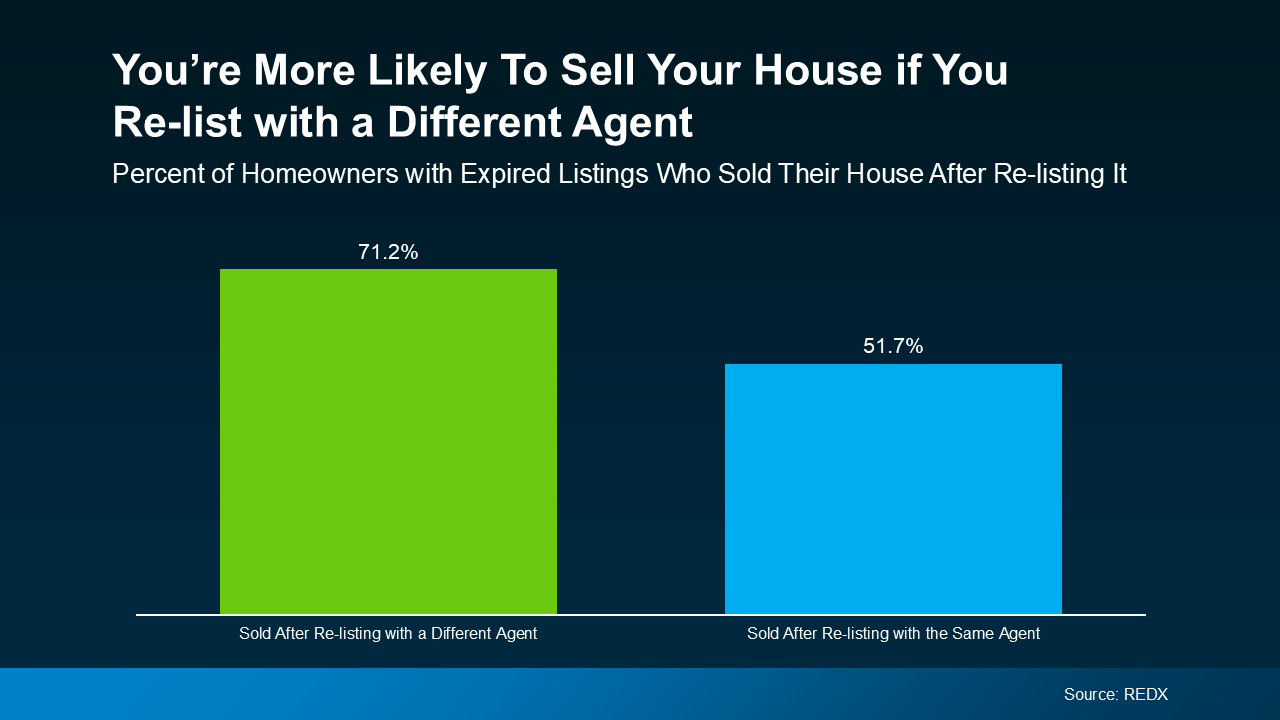

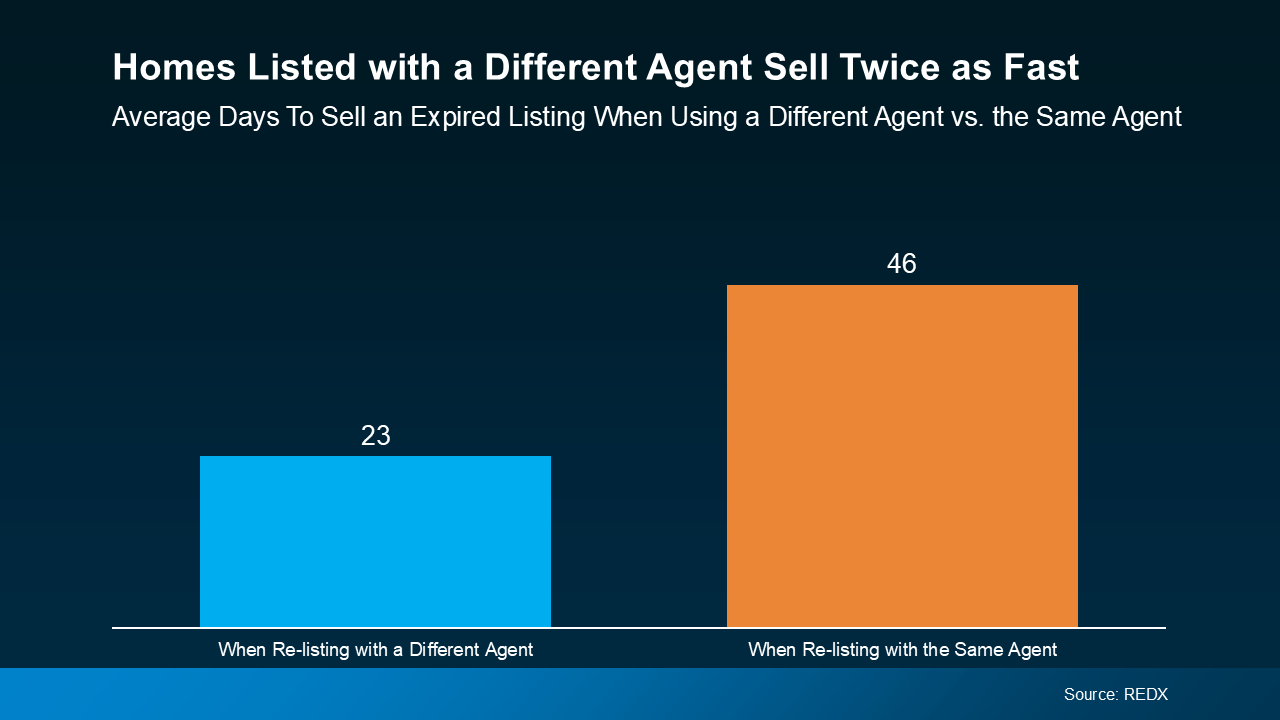

REDX data also shows that only 1 in 3 homeowners with expired listings actually make that change. That means most sellers either give up or repeat the same mistakes, so they get the same disappointing outcome. You deserve better.

REDX data also shows that only 1 in 3 homeowners with expired listings actually make that change. That means most sellers either give up or repeat the same mistakes, so they get the same disappointing outcome. You deserve better. 4. You Weren’t Willing To Negotiate

4. You Weren’t Willing To Negotiate

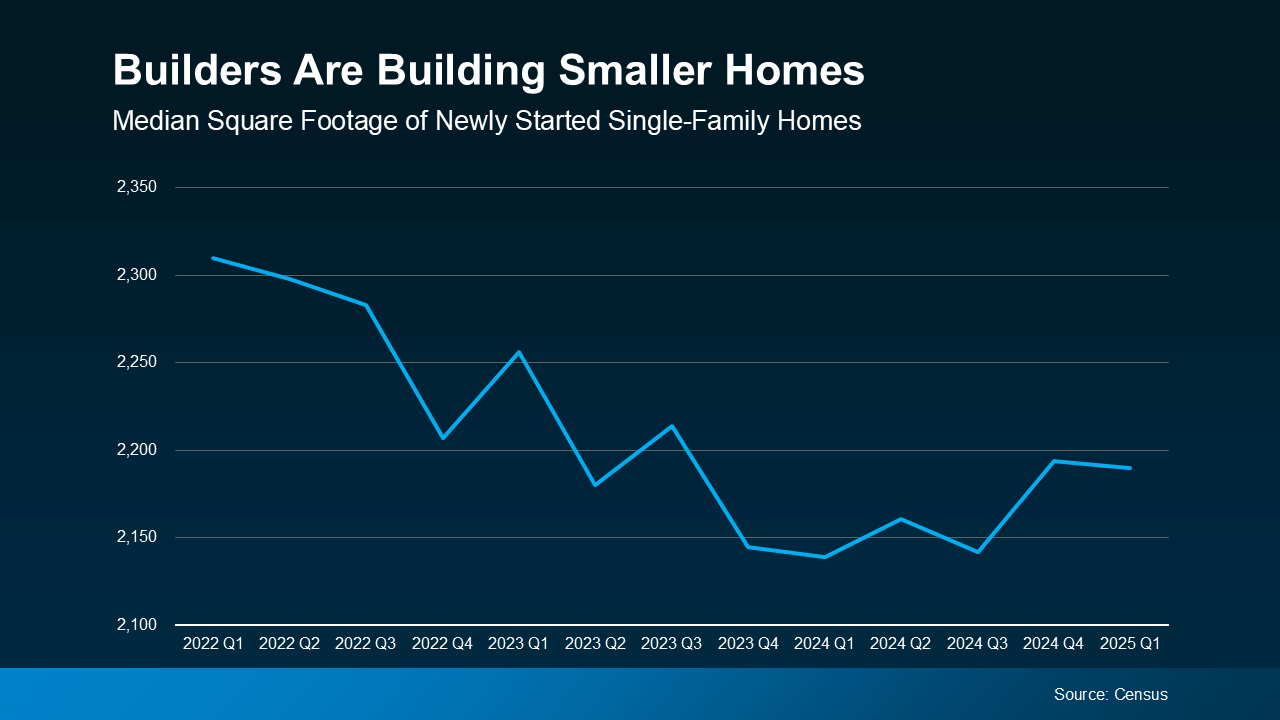

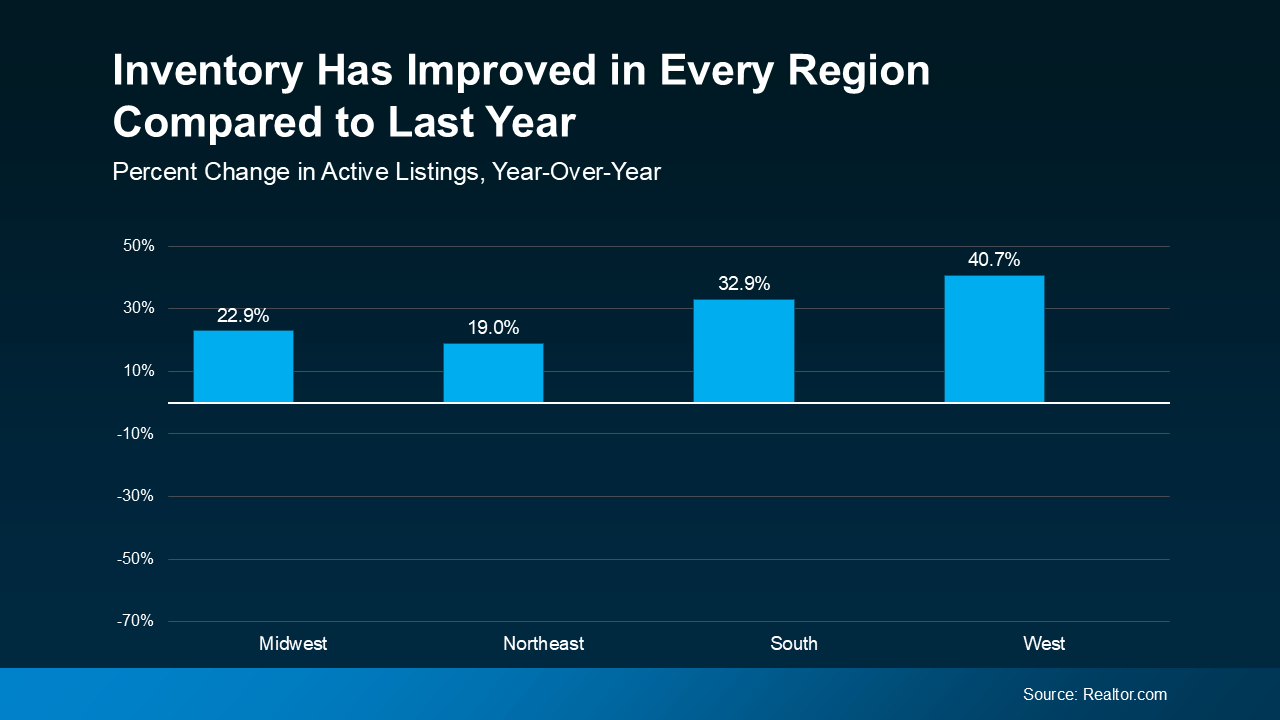

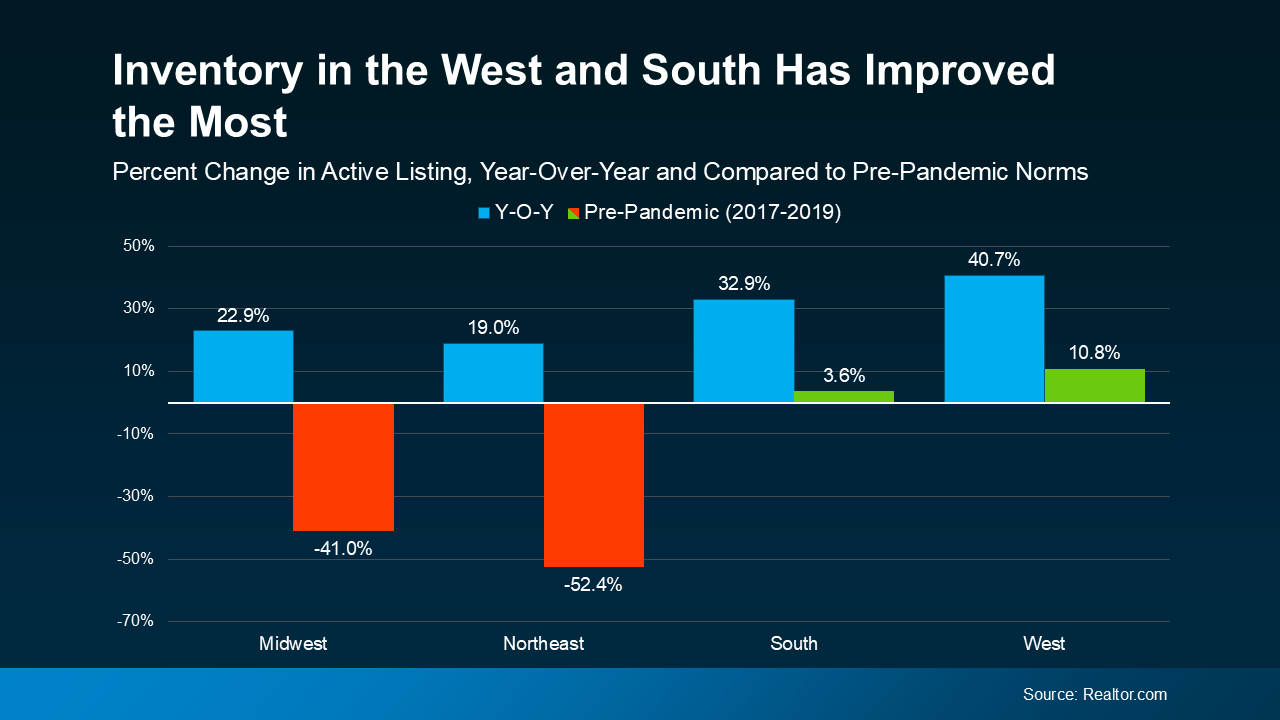

The Big Picture

The Big Picture

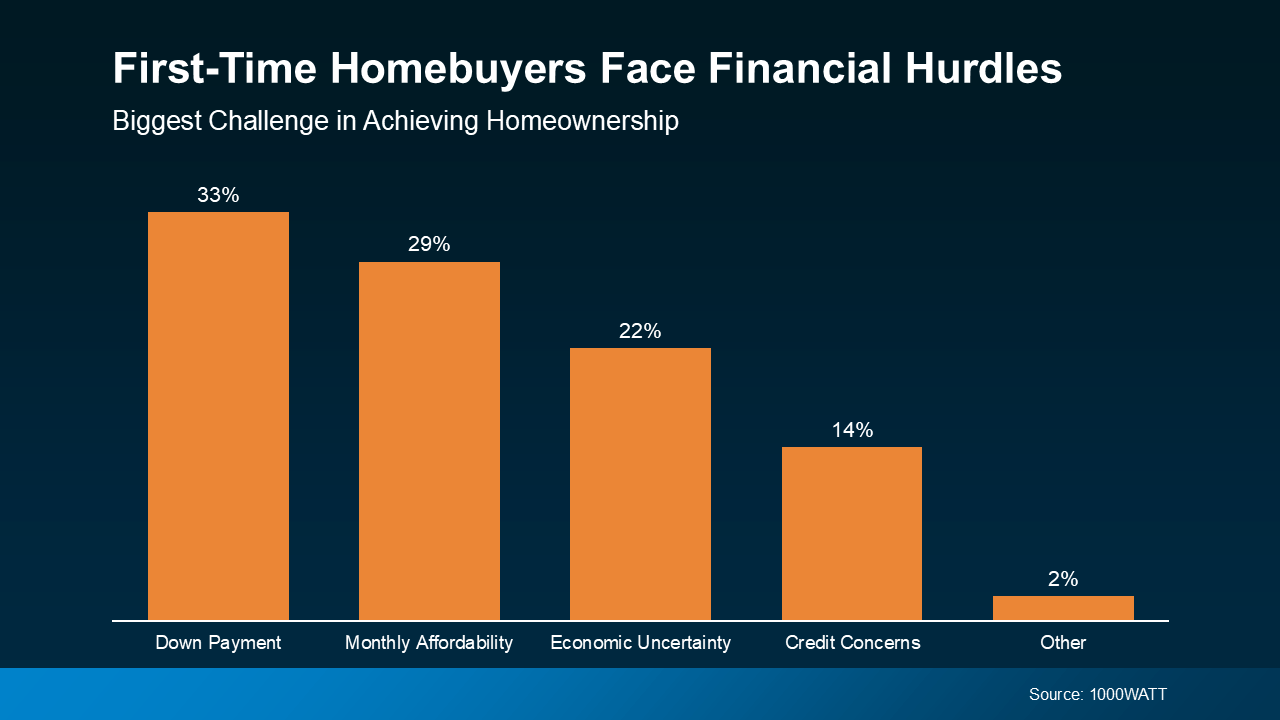

That’s Where FHA Loans Come In

That’s Where FHA Loans Come In Essentially, buyers who use an FHA loan may not have to come up with as much cash up front. But the perks don’t stop there. You may also be able to pay less monthly, too.

Essentially, buyers who use an FHA loan may not have to come up with as much cash up front. But the perks don’t stop there. You may also be able to pay less monthly, too.