Your Real Estate Market Update From your Reid Realtors team

It’s that time again. We’re diving into what’s going on with our local market and what you should know.

Many have felt the change in the market from the pandemic years through where we are currently. If you haven’t experienced it yourself, you know someone who has. Interest rates still remain high and we are seeing fewer people move. Days on market are back to pre-pandemic days (homes are sitting longer) and overall we are adjusting our own expectations, continually learning and communicating these expectations and learnings with our clients.

While we understand that market fluctuations may cause some concern, we want to assure you that there is hope for Real Estate in Memphis and in August alone, we’ve seen an uptick compared to previous months.

Here are some key insights on why you should remain optimistic:

- Despite minor fluctuations, the Memphis real estate market is still showing strength.

- There are plenty of opportunities for both buyers and sellers.

- We anticipate a stable market in the near future.

We’ll show you some numbers and discuss further thoughts below.

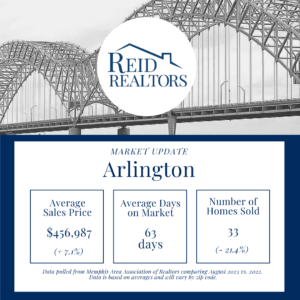

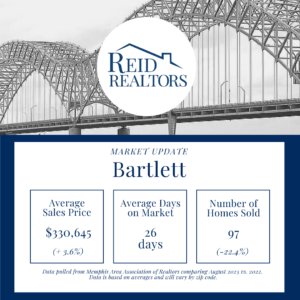

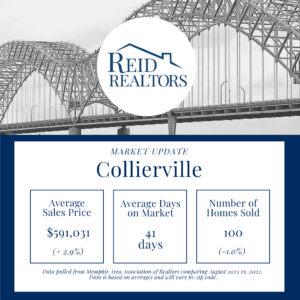

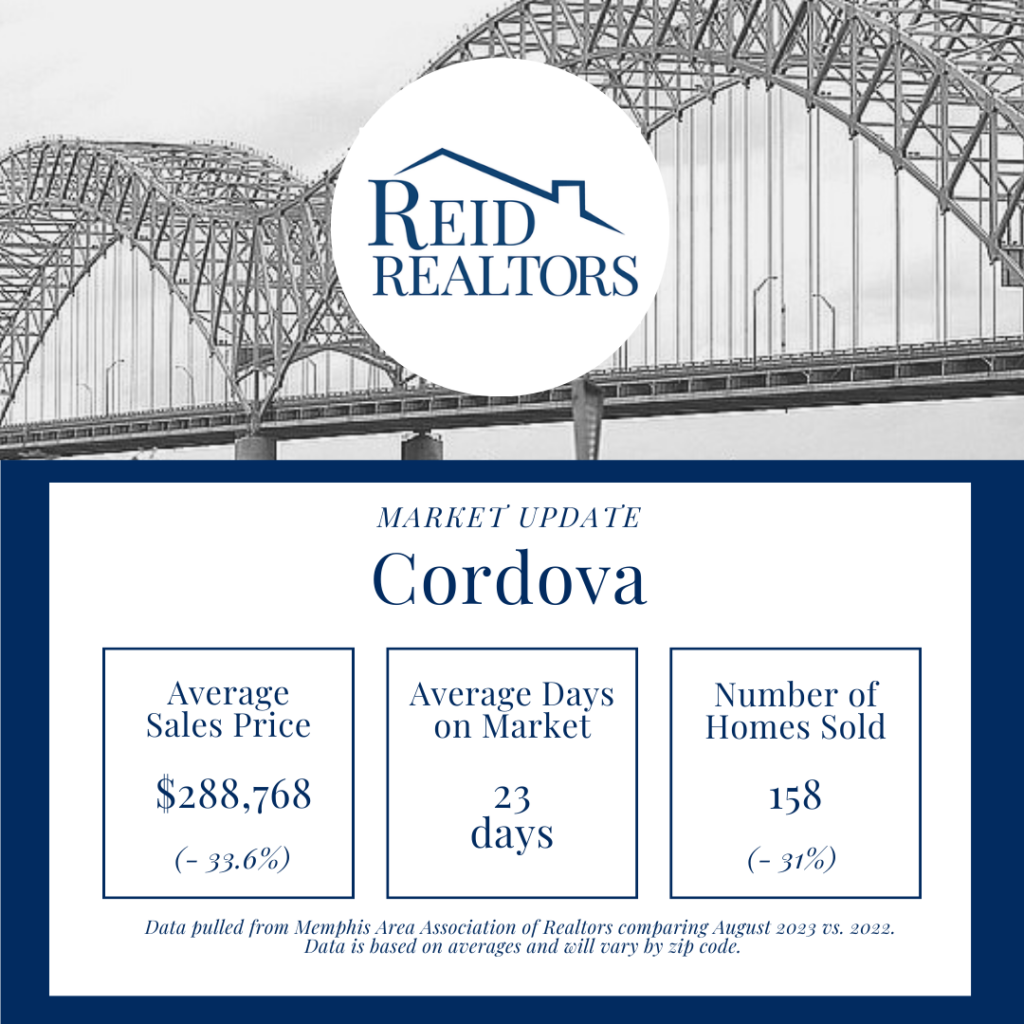

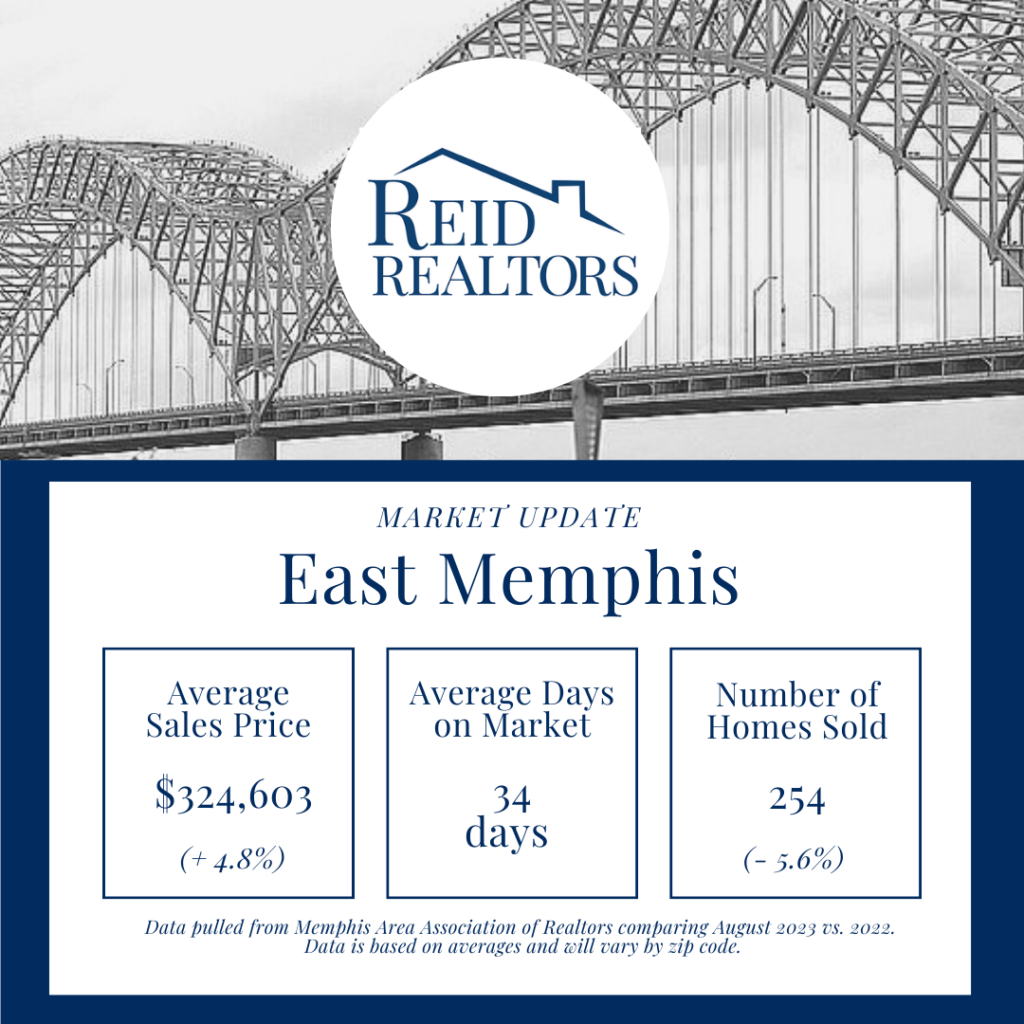

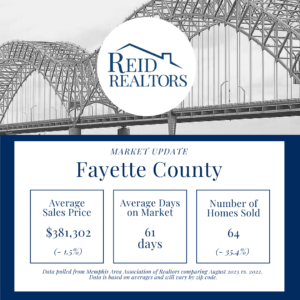

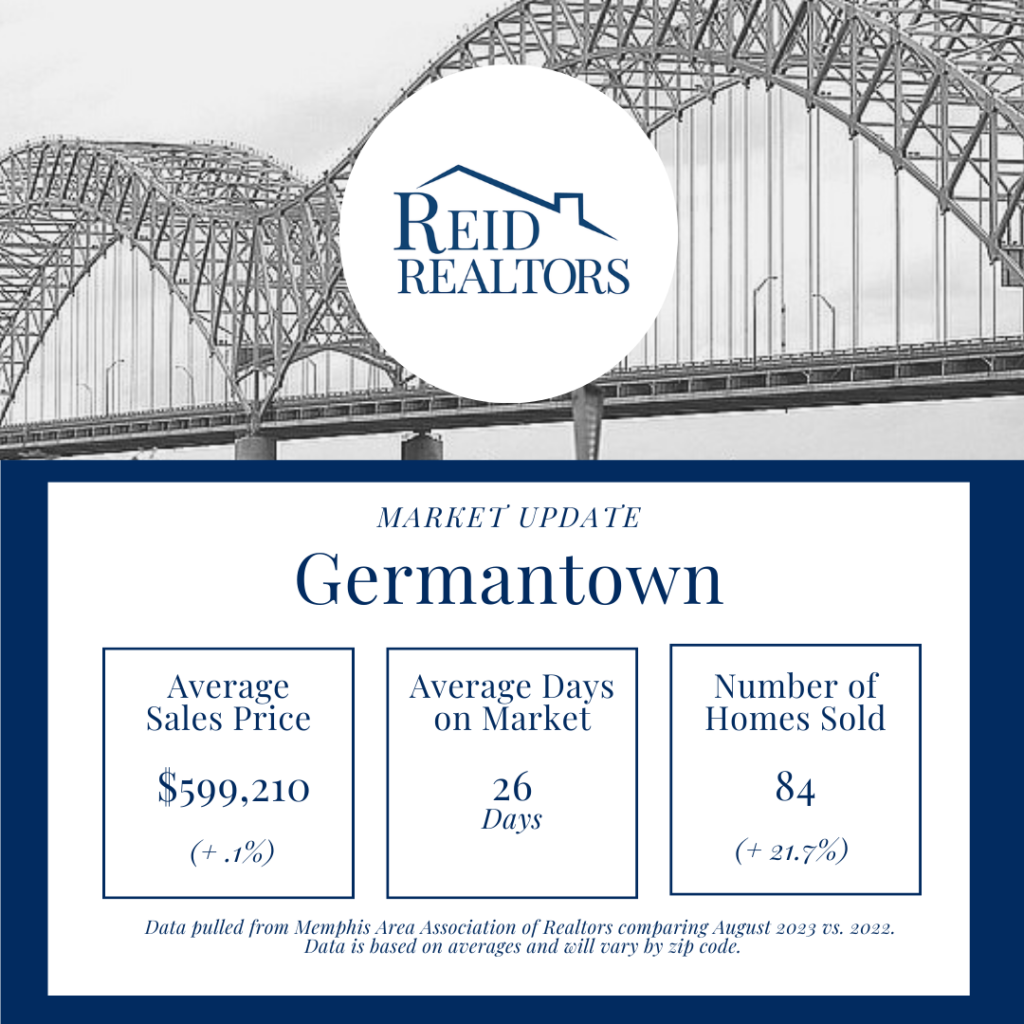

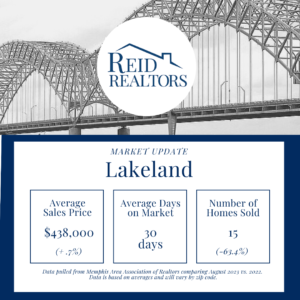

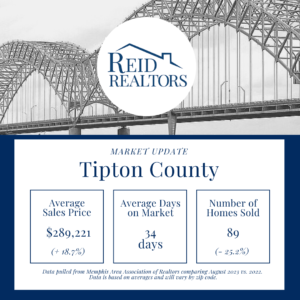

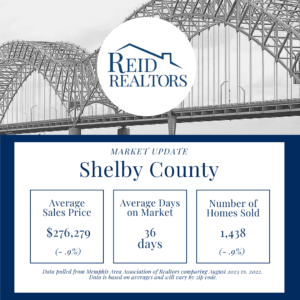

The Numbers

A preview of Shelby County aggregated from the month of August comparing August 2023 vs. August 2022. For information by suburb, click the link below to see your area specifically.

The above gives an overview of the Shelby County. These numbers vary from each area of the city so please click below to view your area.

Understanding Price Sensitivity

While sales are steady or down year over year for most cities in our area, we are starting to see a wider gap in communities with a lower average sales price. Interest rates are playing a major role in this and are having a negative impact on sales volume in these communities. Cities with a higher average sales price are seeing less of a decrease due to less price sensitivity. Regardless of where you fall, we’re committed to working with our clients in every circumstance and partnering with you to meet your goals. We are proud to serve a wide-range of clients from all walks of life across, multiple cities in the Greater Memphis Area.

Readjusting expectations

Our team strives to be authentic, clear and concise with our communication to our clients. One thing that we are having to readjust for ourselves and our clients (especially sellers) is expectations. Two main things we are striving to communicate in this current market to our sellers is 1) pricing your home correctly and 2) being patient after listing.

Overpricing your home in this market is one of the hardest obstacles to overcome if you price too aggressively on the front end. Our goal is to drive people in your door. Pricing too high is a red flag to many buyers that understand comparables in your area. Also, the longer your home sits, you can expect more price drops and more buyers coming in with low offers.

Patience is also key. There’s a fine line between reacting to what the market is telling you (with price) and dropping prices too quickly. Gone are the days that we expect a home to get under contract in a weekend (although in the right circumstances we are still seeing that too). It’s important to understand you need to be patient as there are less buyers in the market.

But you don’t have to do any of this alone. We’re doing this behind the scenes on a daily basis and are ready to guide you and help you navigate this current market.

Opportunities for First Time Home Buyers

While sellers are adjusting expectations, buyers are too. But in this case, they are leveraging their buying power to take more time before making an offer, ask for repairs and closing costs, and be more selective overall when choosing a home.

This presents a great opportunity for first time home buyers as they can slow down, save and find a home that’s right for them.

With rents just as high as mortgages (if not more), it’s smart to assess your situation to see if you can afford to buy a home. Many banks and mortgage companies offer different loans to accommodate first time home buyers. We’d be happy to connect you with reputable lenders to reach out to.