Your Real Estate Market Update From your Reid Realtors team

The number one question we get asked as agents has to be “how’s the market”? So let’s get to it.

Here’s what you may know:

- Interest rates are hovering around 7% with much anticipation about potential drops at upcoming FED meetings scheduled for early March

- Affordability is still the main concern for many people locked in at lower interest rates or for first time home buyers

- There is still low inventory and a smaller pool of buyers

Let’s dive into more numbers and insights below.

The Numbers

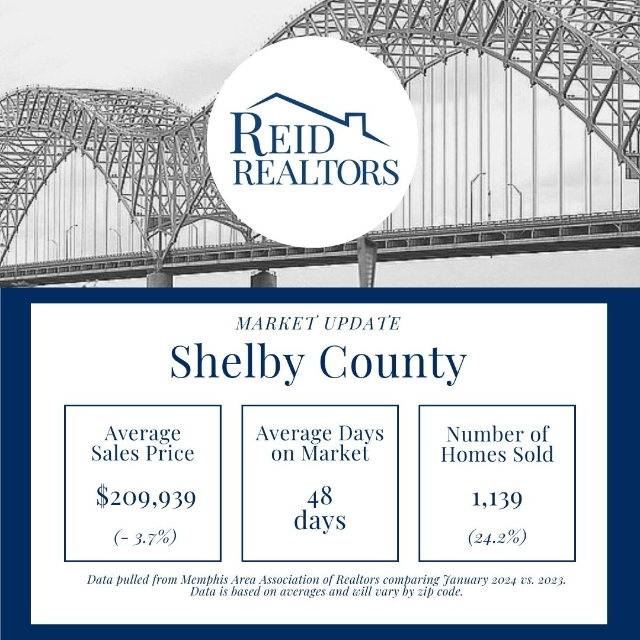

A preview of Shelby County aggregated from the month of January comparing January 2024 vs. January 2023. For information by suburb, please reach out to us directly.

The above gives an overview of Shelby County to understand what’s going on with our local market as a whole. These numbers are directional and vary from each area of the city so please reach out, if you’d like specific numbers for your area.

Affordability remains the top concern for buyers.

This past fall when interest rates rose to a high we haven’t seen in years, we started to see another shift in the market. While we expect winter to be a slower season in Real Estate, we also experienced less buyers in the market overall with affordability as a root cause.

With interest rates now hovering around 7%, this still remains a concern. Buyers that are currently in the market for a home are more calculated about their investment. In a market with lower interest rates, we saw quick decisions being made due to urgency and multiple offer scenarios. Today, buyers are slowing down, taking their time and not settling for a house that doesn’t have what they desire. If they are going to move at this interest rate, it needs to be well worth it.

From our experience, it comes down to a cost/benefit analysis. We have seen clients having to weigh expectations of what they want in a home vs. the cost. Understanding what you can afford should be considered not only at a maximum sales price but also at a monthly mortgage you are comfortable with. We have a great partnership with many local lenders and would be happy to connect you if you are curious as to what a new mortgage could look like.

Our advice to buyers? Think through your long term goals. Let’s talk about where Real Estate falls in the picture for you and what timing would be best. If you are a first time home buyer paying rent but can afford a down payment, you may want to consider investing in Real Estate now as mortgage rates and rent rates may be comparable.

It will take longer to sell your home.

Average days on market are at an average of 48 days with many of the city higher than this. However, last January we saw an average days on market at 43. While this isn’t a drastic change based on seasonality, as we mentioned previously, expectations of buyers have changed.

Not only should your home be show-ready, but you have to ensure the buyers see value for the price. Value mostly comes in pricing conservatively, offering allowances, closing costs, credits or rate-buy downs.

While making repairs ahead of time and staging your home appropriately is always good thing to do, this won’t necessarily drive showings to your home if it’s not paired with a solid pricing and marketing strategy.

There are different approaches to pricing your home in a market like this one. Depending on your time, resources and goals, we can help craft the best strategy for you.

There’s a balance of more homes sold but a slight dip in prices.

Overall home prices have come down 3.7% in January 2024 compared to January 2023 in Shelby County. However, homes sold are up 24.2%

This indicates that the market is correcting itself slightly from higher sales prices in years past but also that it’s taking a dip in prices to sale more units.

Where we see this playing out in our local market is many homes accepting offers lower than asking price. For a buyer, understanding how days on market can impact your offer is key. For a seller, having realistic expectations and getting pricing right on the front end is essential.

Now more than ever, is the right time to have an agent on your side to help you navigate through a market that is changing by the week. And as always, we are here to help!