The number of homes for sale is playing a big role in today’s housing market. And, if you’re considering whether or not to list your house, today’s limited supply is one of the biggest advantages you have right now. That’s because your house stands out more when the inventory is low, especially if it’s priced right.

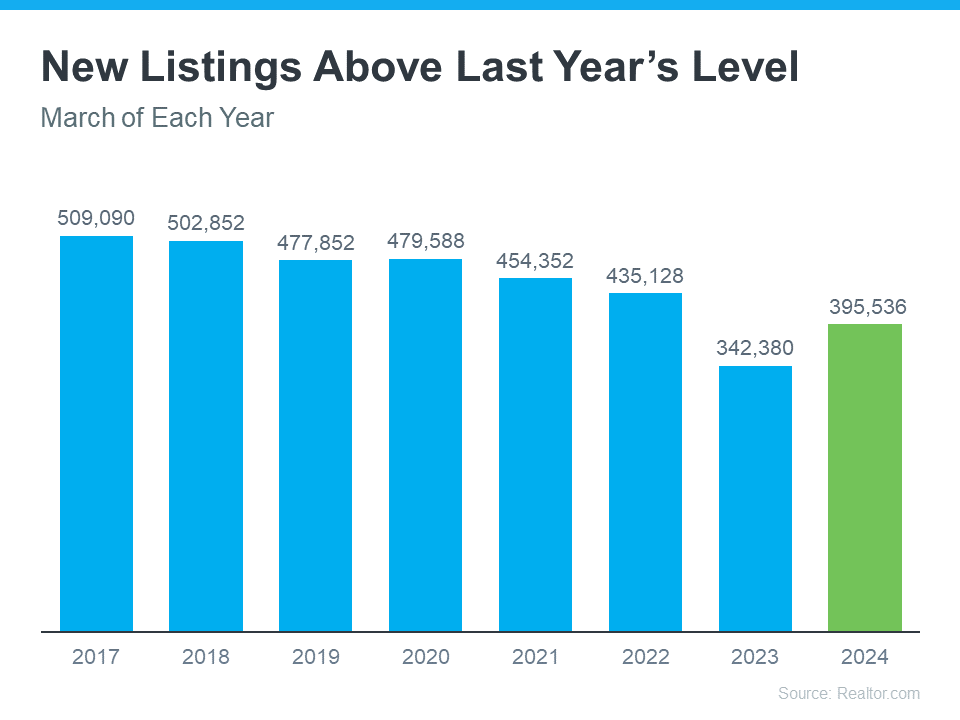

But the supply of homes for sale is growing. According to the latest data from Realtor.com, new listings (homeowners who just put their house up for sale) are trending up (see graph below):

This graph shows more homeowners are putting that sale sign up in their yards compared to the same time last year. As Realtor.com says:

“. . . sellers turned out in higher numbers this March as newly listed homes were 15.5% above last year’s levels. This marked the fifth month of increasing listing activity after a 17-month streak of decline.”

What This Means for You

If you’ve been putting off selling your house, maybe it’s time to start thinking about it again – before your neighbors do. While we’re not going to suddenly have a surplus of homes for sale, each house that pops on the market in your area runs the risk of pulling buyer attention away from yours.

For example, if your neighbor gets in on the action and lists their house too, it means you’ll have competition right next door. You don’t want buyers to tour your house and fall in love with someone else’s. You want yours to be in the spotlight.

A great agent can make that happen. They’ll help you get your house ready to list, draw attention to everything today’s buyers are looking for, and help you price it right. That way buyers are really drawn to your listing and eager to make it their home.

If you’re ready and able to sell now, here’s your chance to get the best of both worlds. Since the supply of homes for sale is growing, you’ll have more options for your own move. But you’ll also be able to sell while your house will still stand out.

Bottom Line

Even though inventory is still low, you don’t want to wait for more competition to pop up in your neighborhood. Connect with a local real estate agent to go over the perks of selling before more homes come to the market.