When you read about the housing market in the news, you might see something about a recent decision made by the Federal Reserve (the Fed). But how does this decision affect you and your plans to buy a home? Here’s what you need to know.

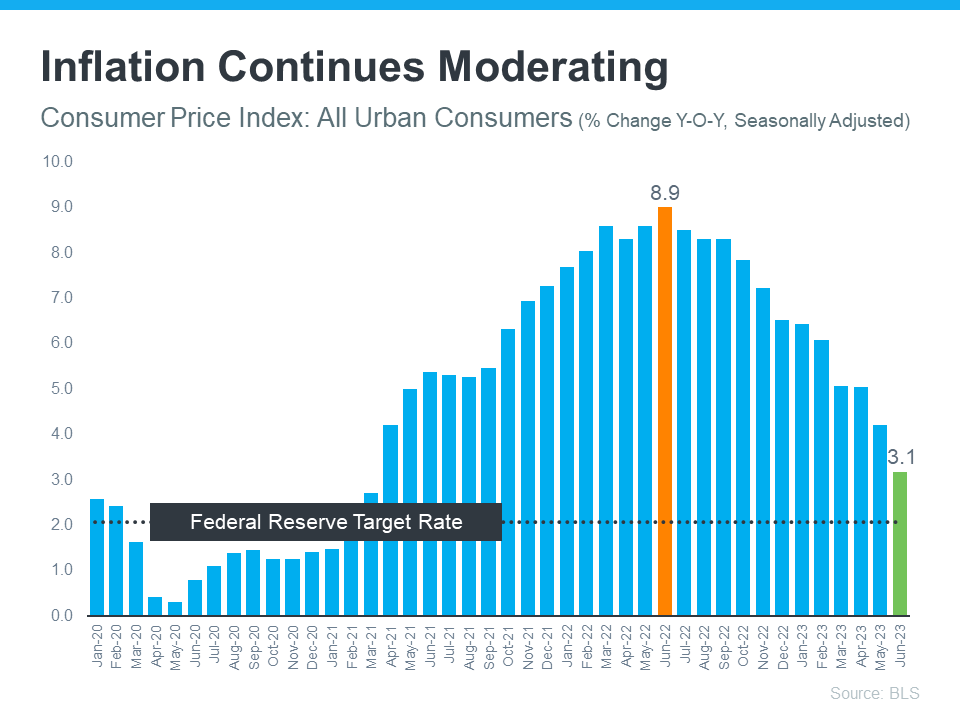

The Fed is trying hard to reduce inflation. And even though there’s been 12 straight months where inflation has cooled (see graph below), the most recent data shows it’s still higher than the Fed’s target of 2%:

While you may have been hoping the Fed would stop their hikes since they’re making progress on their goal of bringing down inflation, they don’t want to stop too soon, and risk inflation climbing back up as a result. Because of this, the Fed decided to increase the Federal Funds Rate again last week. As Jerome Powell, Chairman of the Fed, says:

“We remain committed to bringing inflation back to our 2 percent goal and to keeping longer-term inflation expectations well anchored.”

Greg McBride, Senior VP, and Chief Financial Analyst at Bankrate, explains how high inflation and a strong economy play into the Fed’s recent decision:

“Inflation remains stubbornly high. The economy has been remarkably resilient, the labor market is still robust, but that may be contributing to the stubbornly high inflation. So, Fed has to pump the brakes a bit more.”

Even though a Federal Fund Rate hike by the Fed doesn’t directly dictate what happens with mortgage rates, it does have an impact. As a recent article from Fortune says:

“The federal funds rate is an interest rate that banks charge other banks when they lend one another money . . . When inflation is running high, the Fed will increase rates to increase the cost of borrowing and slow down the economy. When it’s too low, they’ll lower rates to stimulate the economy and get things moving again.”

How All of This Affects You

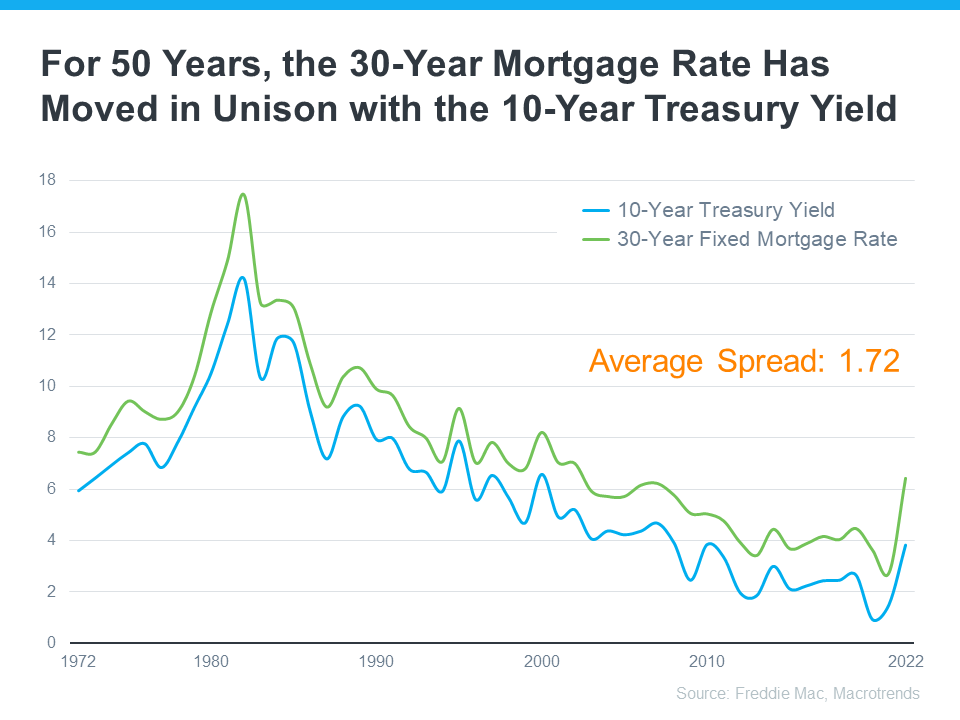

In the simplest sense, when inflation is high, mortgage rates are also high. But, if the Fed succeeds in bringing down inflation, it could ultimately lead to lower mortgage rates, making it more affordable for you to buy a home.

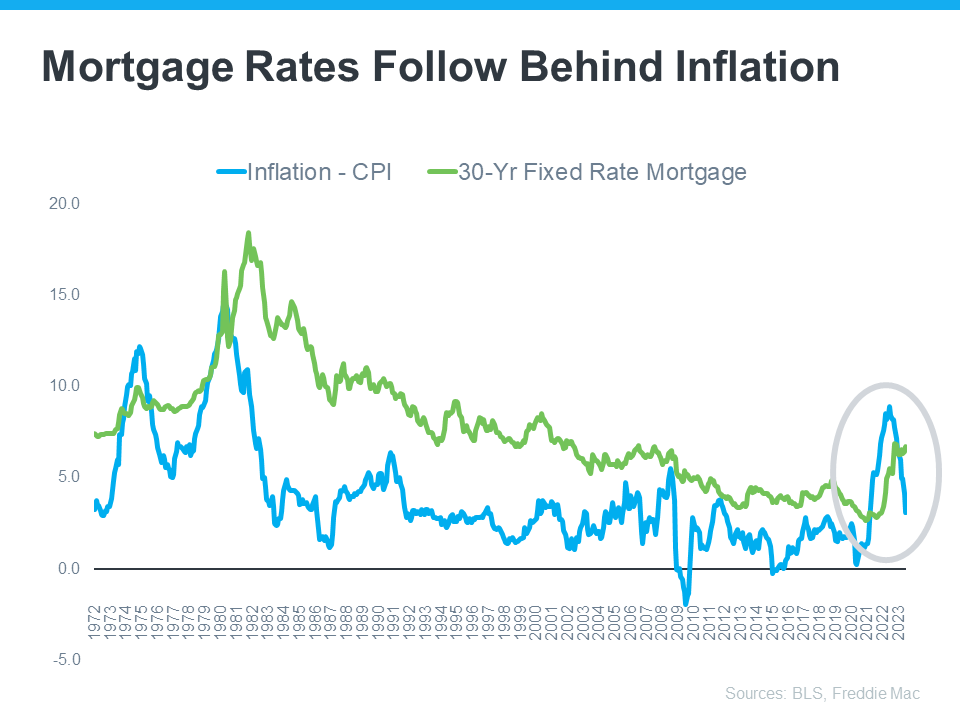

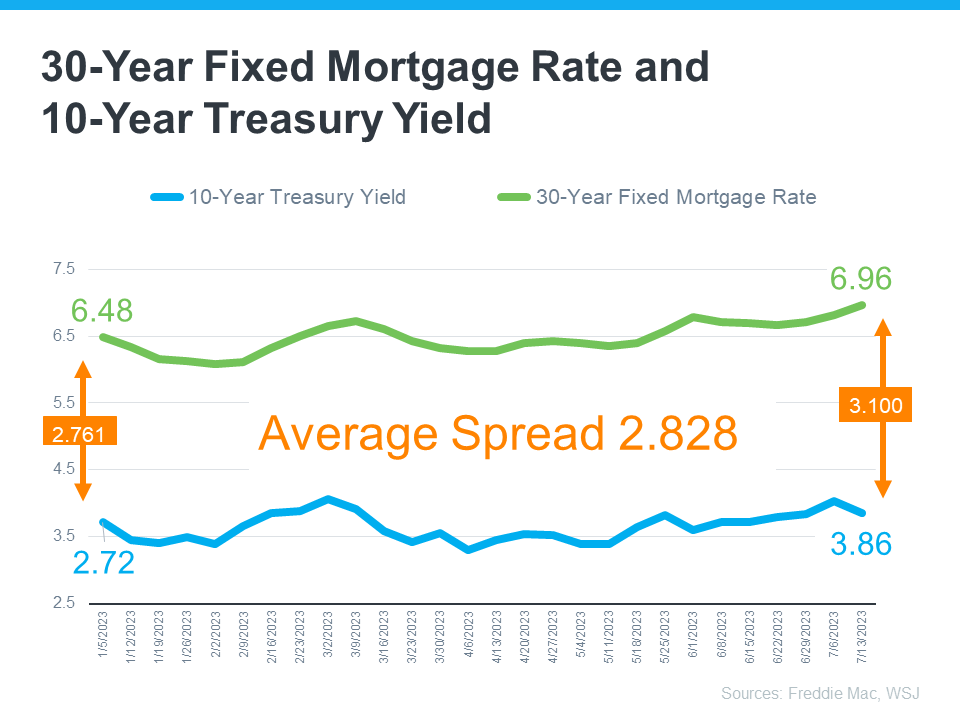

This graph helps illustrate that point by showing that when inflation decreases, mortgage rates typically go down, too (see graph below):

As the data above shows, inflation (shown in the blue trend line) is slowly coming down and, based on historical trends, mortgage rates (shown in the green trend line) are likely to follow. McBride says this about the future of mortgage rates:

“With the backdrop of easing inflation pressures, we should see more consistent declines in mortgage rates as the year progresses, particularly if the economy and labor market slow noticeably.”

Bottom Line

What happens to mortgage rates depends on inflation. If inflation cools down, mortgage rates should go down too. Count on a real estate professional you can trust for expert advice on housing market changes and what they mean for you.