Have you ever wondered how inflation impacts the housing market? Believe it or not, they’re connected. Whenever there are changes to one, both are affected. Here’s a high-level overview of the connection between the two.

The Relationship Between Housing Inflation and Overall Inflation

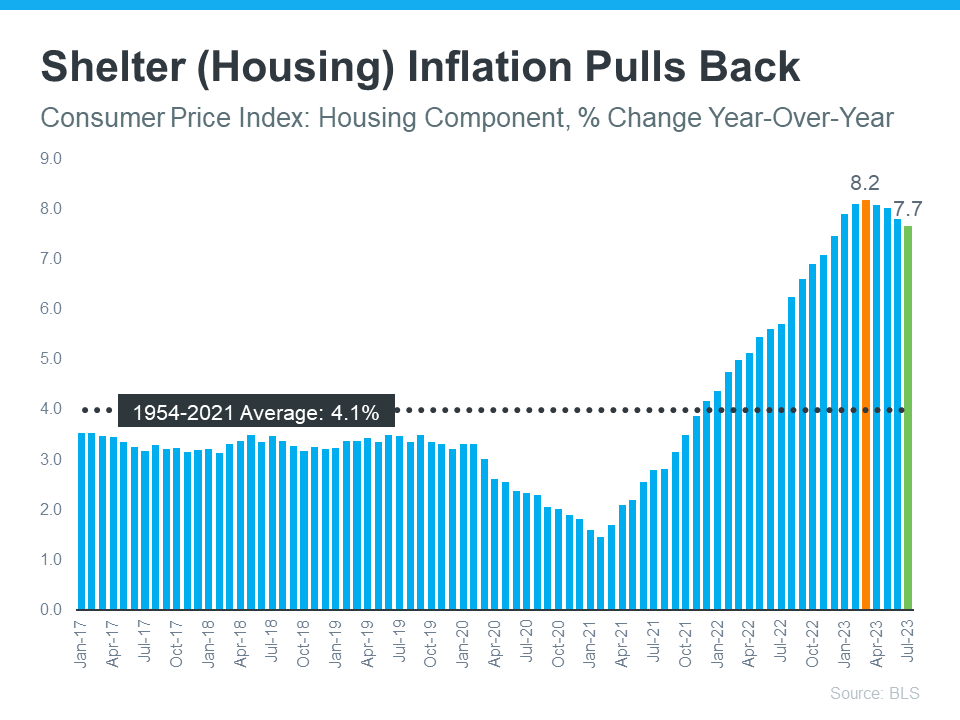

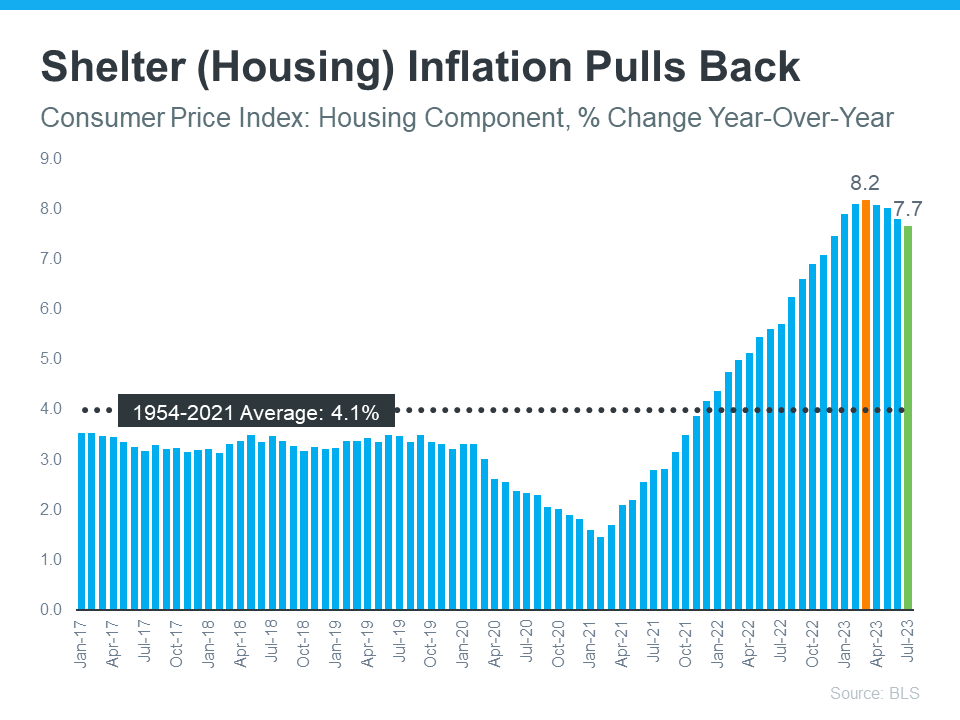

Shelter inflation is the measure of price growth specific to housing. It comes from a survey of renters and homeowners that’s done by the Bureau of Labor Statistics (BLS). The survey asks renters how much they’re paying in rent, and homeowners how much they’d rent their homes for, if they weren’t living in them.

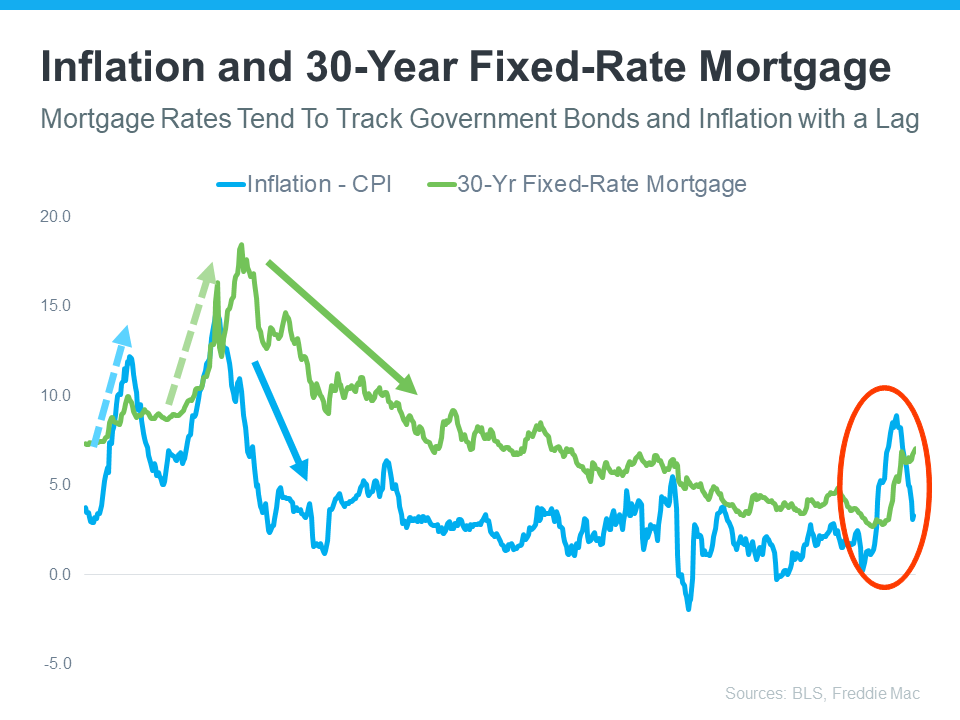

Much like overall inflation measures the cost of everyday items, shelter inflation measures the cost of housing. And for four consecutive months, based on that survey, shelter inflation has been coming down (see graph below):

Why does this matter? Well, shelter inflation makes up about one-third of overall inflation, as measured by the Consumer Price Index (CPI). So, when shelter inflation moves, it leads to noticeable moves in overall inflation. That means the recent dip in shelter inflation might be a sign that overall inflation could fall in the months ahead.

Why does this matter? Well, shelter inflation makes up about one-third of overall inflation, as measured by the Consumer Price Index (CPI). So, when shelter inflation moves, it leads to noticeable moves in overall inflation. That means the recent dip in shelter inflation might be a sign that overall inflation could fall in the months ahead.

That moderation would be a welcome sight for the Federal Reserve (the Fed). They’ve been working to get inflation under control since early 2022. While they’ve made some headway (it peaked at 8.9% in the middle of last year), they’re still trying to get to their 2% goal (the latest report is 3.3%).

Inflation and the Federal Funds Rate

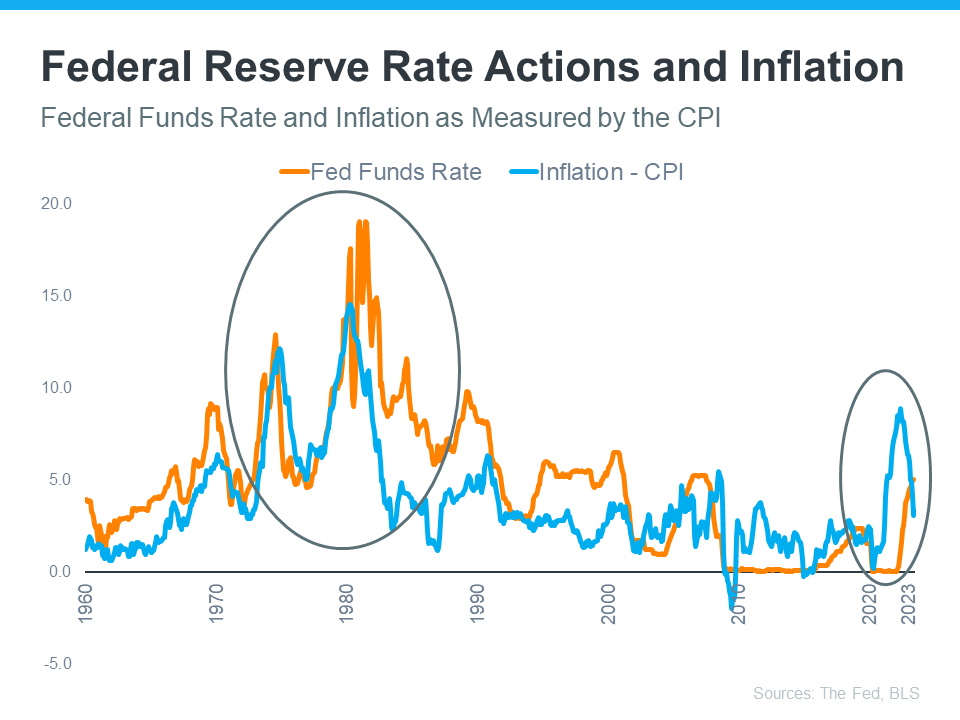

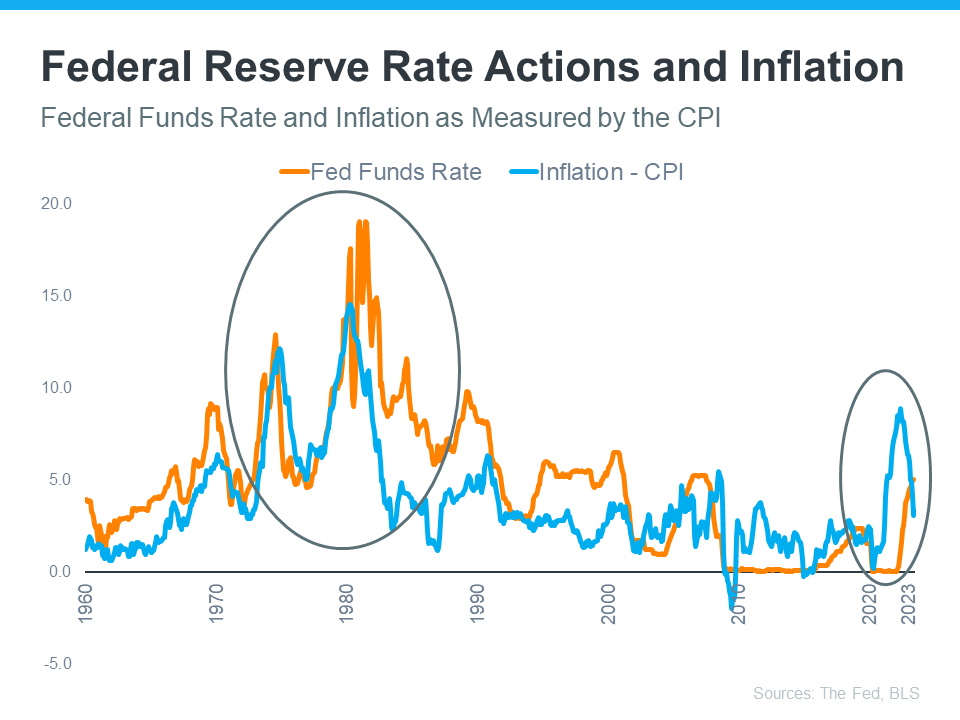

What’s the Fed been doing to lower inflation? They’ve been increasing the Federal Funds Rate. That interest rate influences how much it costs banks to borrow money from each other. When inflation climbed, the Fed responded by raising the Federal Funds Rate to keep the economy from overheating.

The graph below shows the relationship between the two. Each time inflation (shown in the blue line) starts to climb, the Fed raises the Federal Funds Rate (shown in the orange line) to try to get it back to their target of 2% (see below):

The circled portion of the graph shows the most recent spike in inflation, the Fed’s actions to raise the Federal Funds Rate to fight that, and the moderation of inflation that happened in response to that hike. As inflation gets closer to the Fed’s current 2% goal, they may not need to raise the Federal Funds Rate much further.

The circled portion of the graph shows the most recent spike in inflation, the Fed’s actions to raise the Federal Funds Rate to fight that, and the moderation of inflation that happened in response to that hike. As inflation gets closer to the Fed’s current 2% goal, they may not need to raise the Federal Funds Rate much further.

A Brighter Future for Mortgage Rates?

So, what does all of this mean for you? While the actions coming out of the Fed don’t determine mortgage rates, they do have an impact. As Mortgage Professional America (MPA) explains:

“. . . mortgage rates and inflation are connected, however indirectly. When inflation rises, mortgage rates rise to keep up with the value of the US dollar. When inflation drops, mortgage rates follow suit.”

While no one can predict the future for mortgage rates, it’s encouraging to see the signs of moderating inflation in the economy.

Bottom Line

Whether you’re looking to buy, sell, or just stay informed about the housing market, connect with a local real estate expert who can help.