Spring is in full swing, and the housing market is picking up along with it. And if you’ve been wondering whether now is the right time to buy or sell, here’s the inside scoop on why this spring may be a great time to make your move.

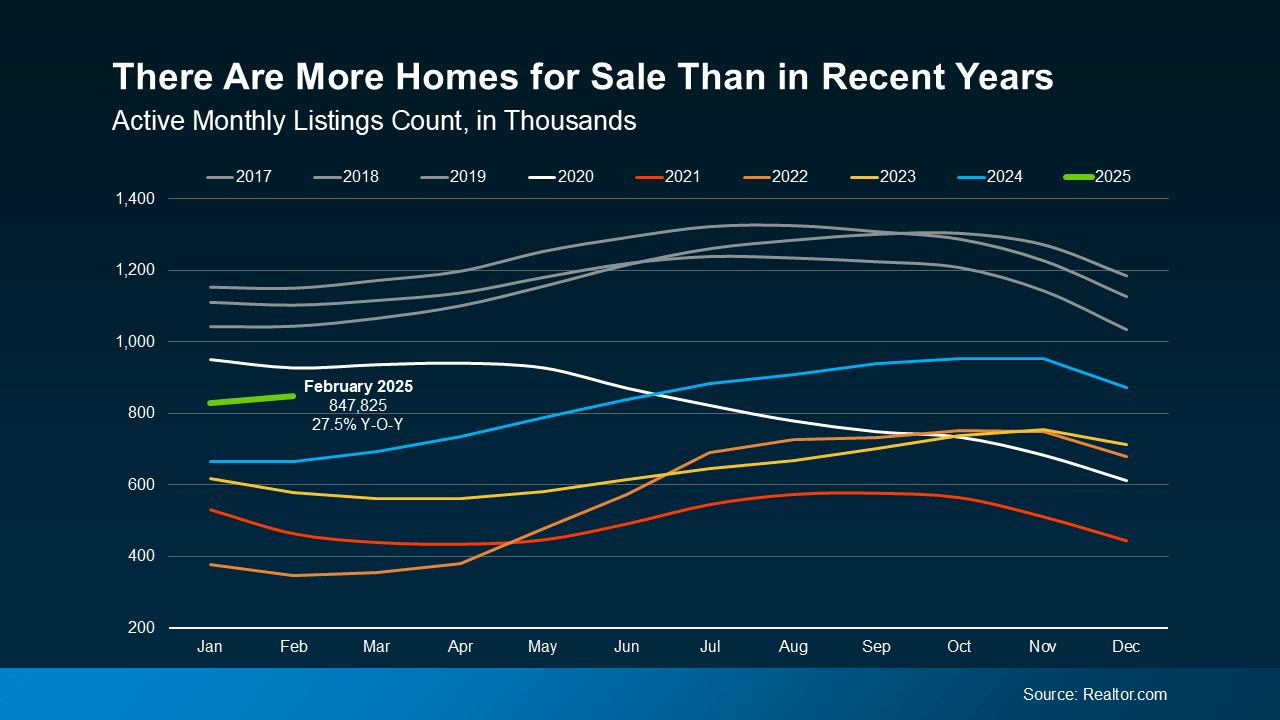

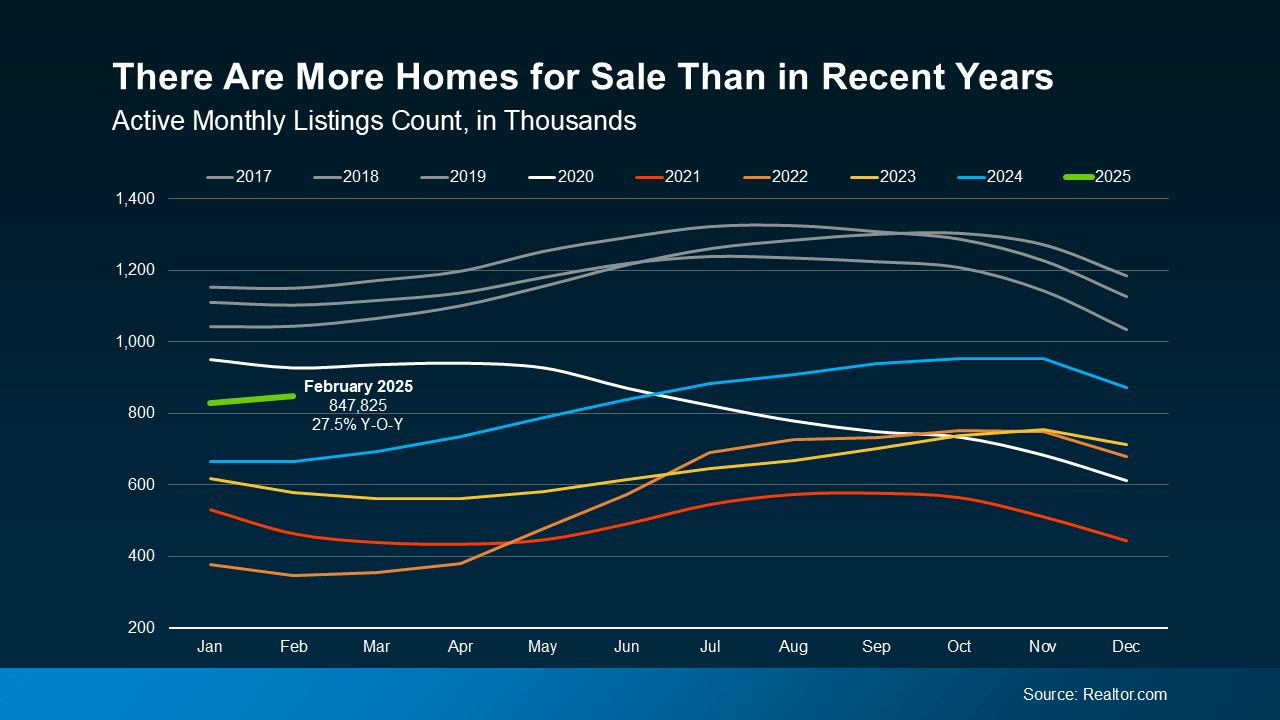

1. There Are More Homes for Sale

After a long stretch of tight inventory, the number of homes for sale is finally improving. According to recent national data from Realtor.com, active listings are up 27.5% compared to this time last year.

Look at the graph below and follow the green line for 2025. You can see, even though inventory levels still haven’t returned to pre-pandemic norms (shown in gray), that number is higher than it has been going into the spring market over the past few years (see graph below):

Buyers: This means you have more choices, and you can be more selective.

Buyers: This means you have more choices, and you can be more selective.

Sellers: With more homes available than in recent years, you’re more likely to find what you’re looking for when you move. And knowing that inventory is still below more normal levels means there will be demand for your home when you sell it, too.

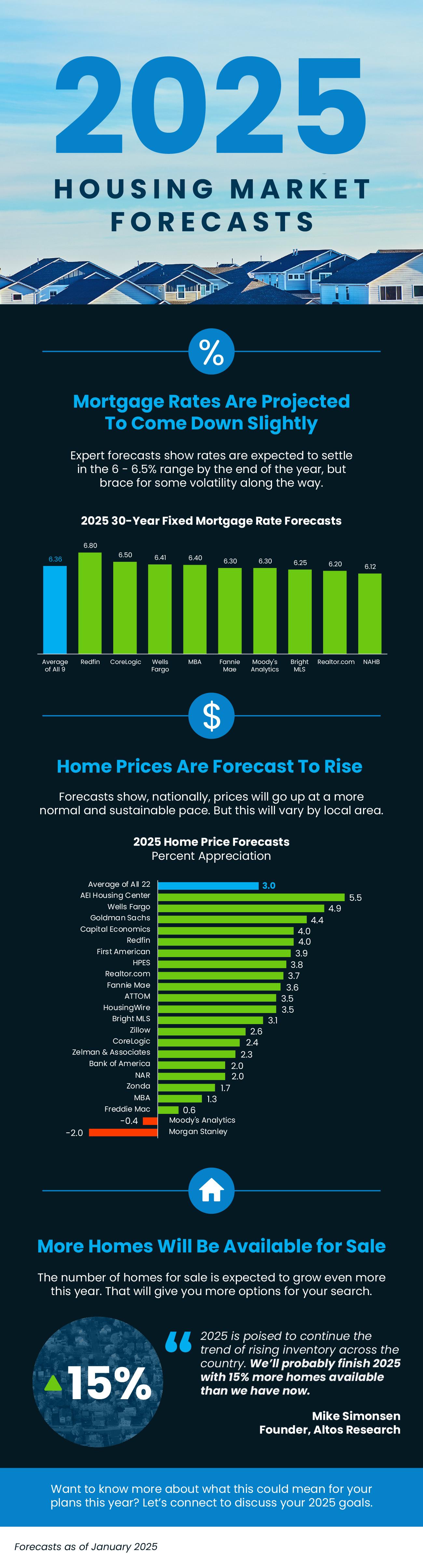

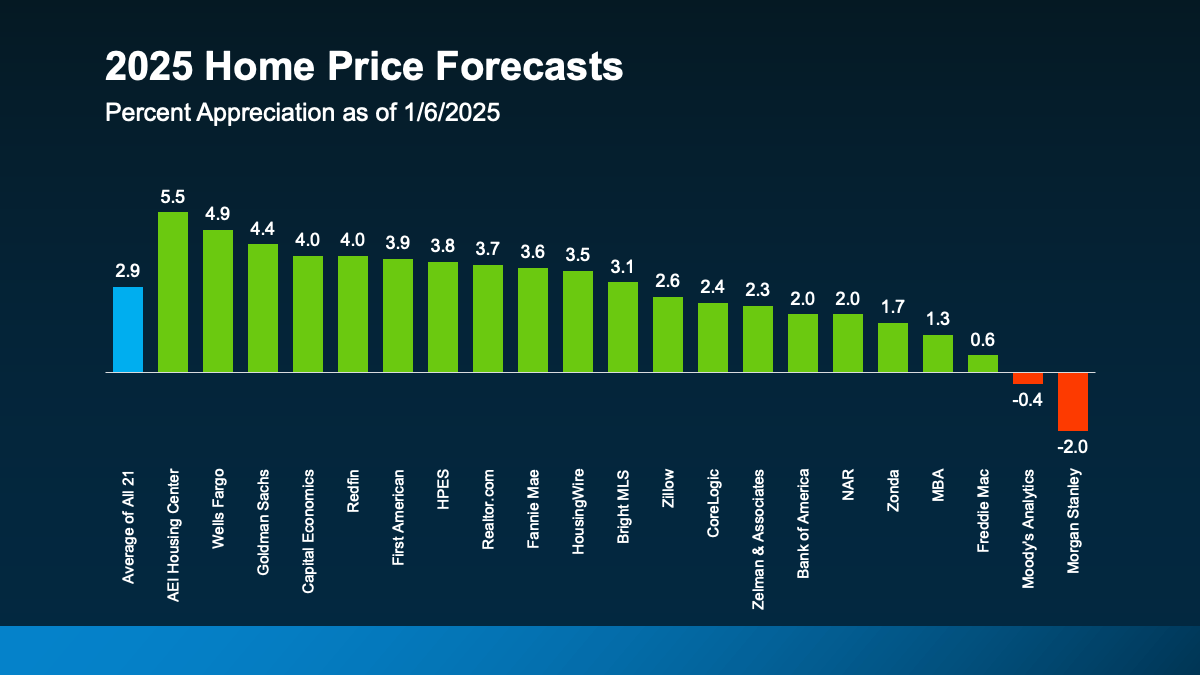

2. Home Price Growth Is Moderating

As inventory grows, the pace of home price growth is slowing down – and that will continue into the spring market. This is because prices are driven by supply and demand. When there are more homes for sale, buyers have more options, so there’s less competition for each house. Rising supply and less buyer competition causes price growth to slow, but it should still remain positive in most markets. As Freddie Mac says:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

And while prices aren’t dropping at the national level, every market is different. Some areas are seeing stronger price growth, while others are cooling off or even seeing some price declines.

Buyers: The slower pace of growth means prices aren’t rising as quickly as before – and that’s a relief. Any home you buy now is likely to appreciate in value over time, helping you build equity.

Sellers: While prices are still rising, you might need to adjust your expectations. Overpricing your house in a more balanced market could mean it takes longer to sell. Pricing your house competitively is going to be key to attracting offers.

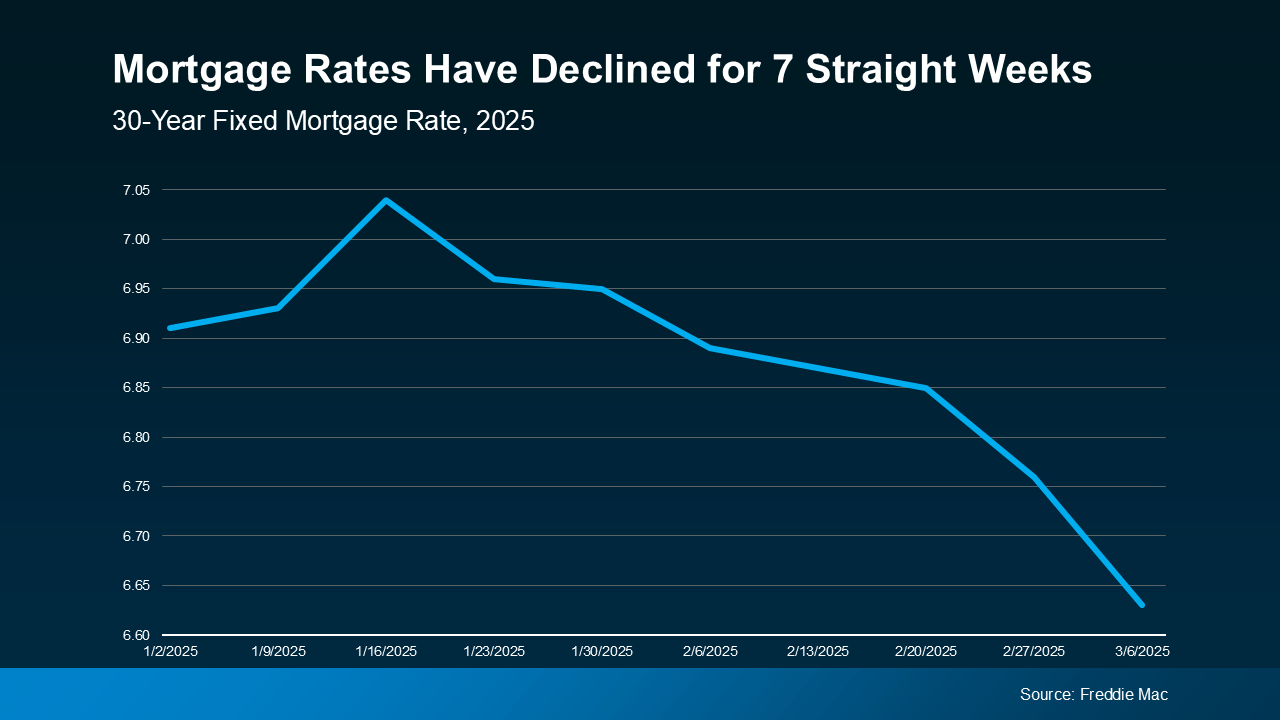

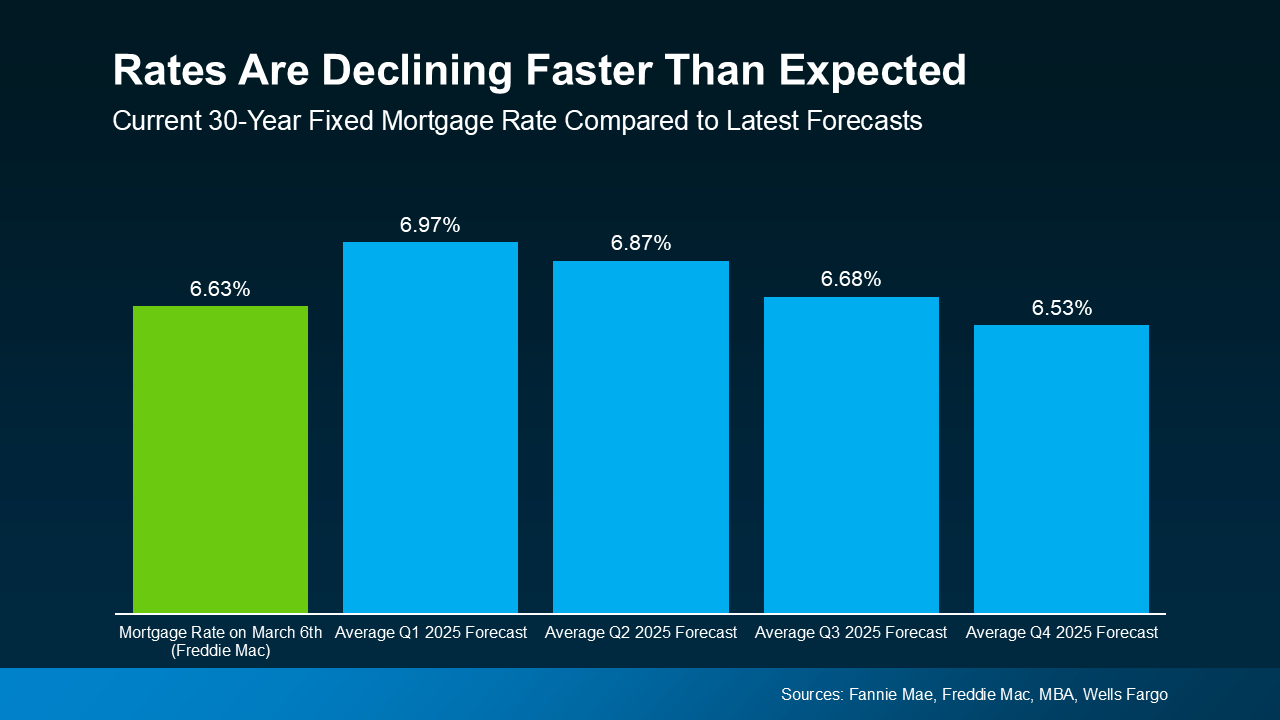

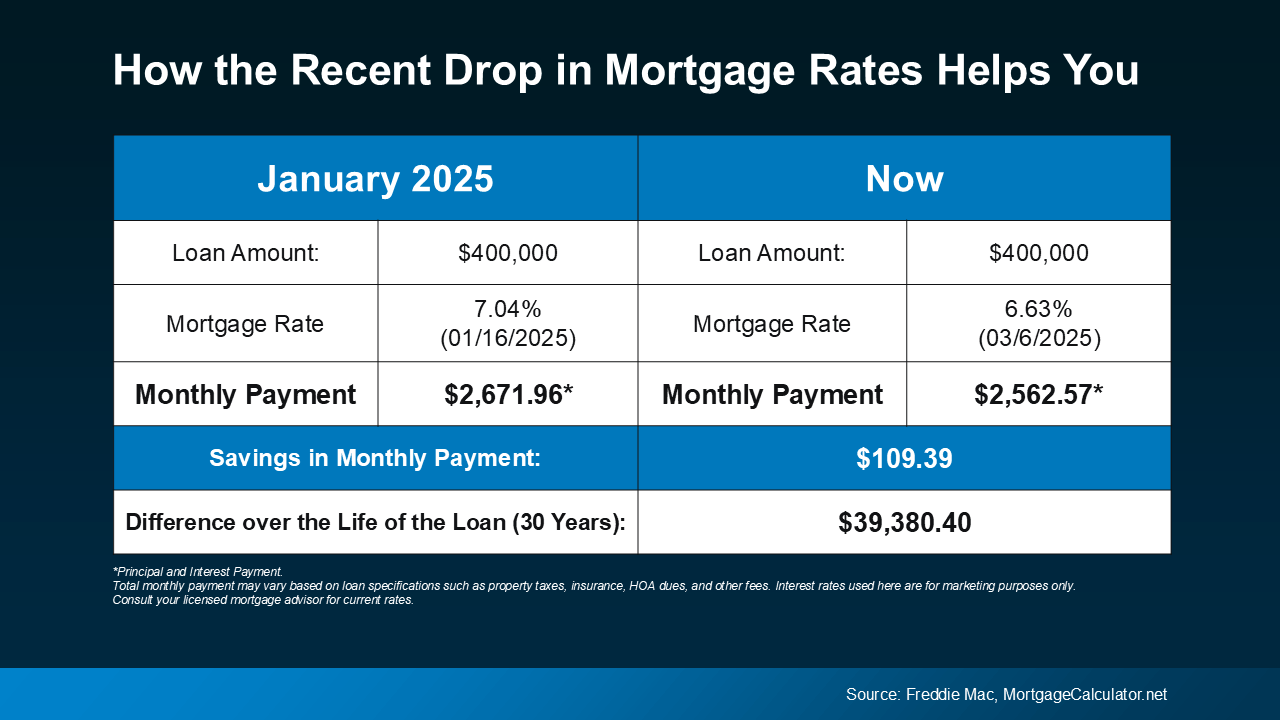

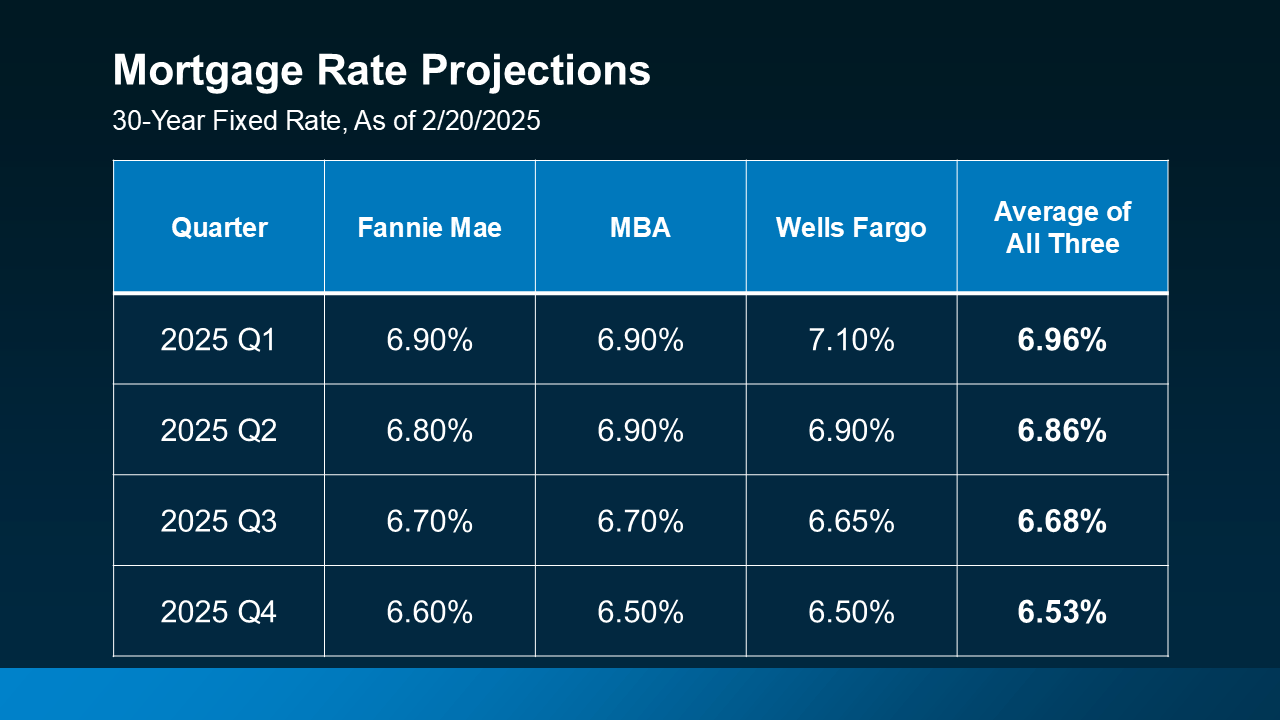

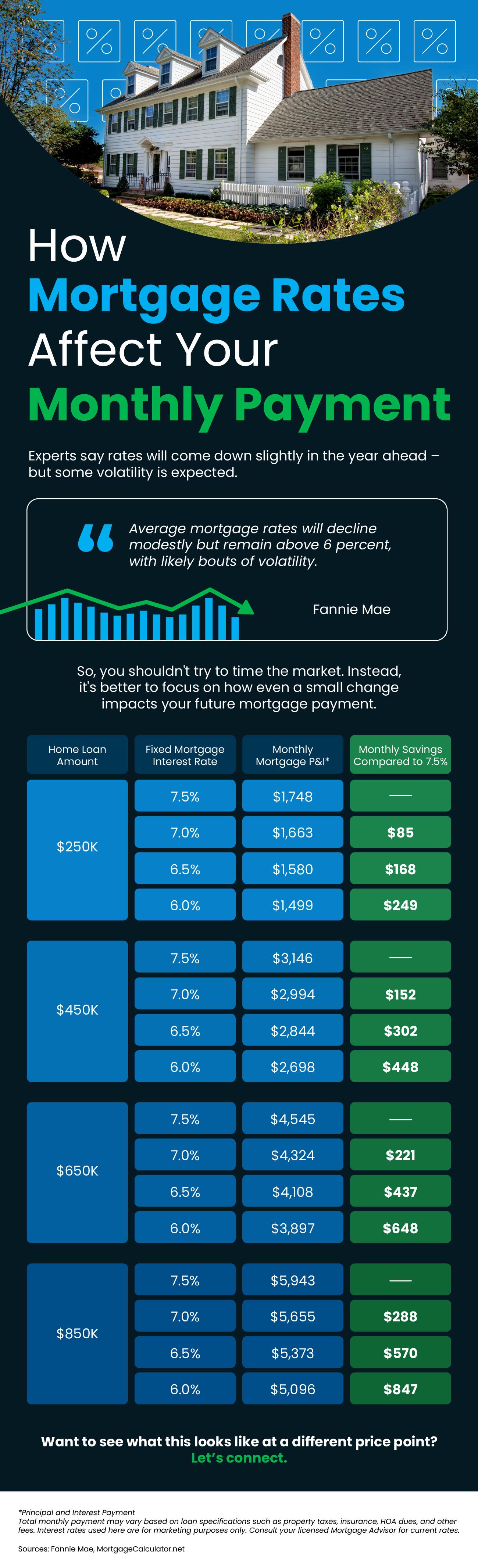

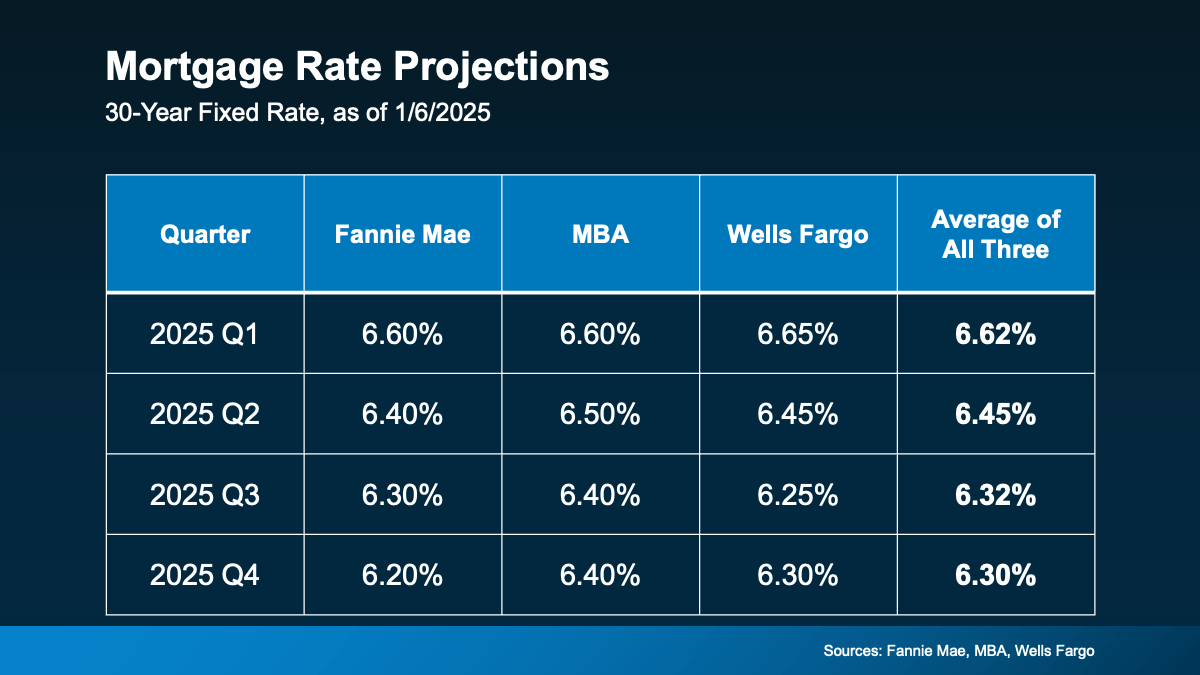

3. Mortgage Rates Are Stabilizing

One of the biggest hurdles for buyers over the past couple of years has been high, volatile mortgage rates. But there’s some good news – overall, they’ve stabilized in recent weeks – and have even declined a bit since the beginning of this year. And while that decrease hasn’t been a big drop, stabilizing mortgage rates has helped make buying a home a bit more predictable. According to Selma Hepp, Chief Economist at CoreLogic:

“With the spring homebuying season upon us, the recent improvements in mortgage rates may help invite homebuyers back into the market.”

Buyers: When mortgage rates are more stable, it’s easier to plan ahead because you have a better idea of what your future payment might be. But remember, rates will continue to be volatile. So, lean on your agent and your lender to make sure you know what the latest mortgage rate means for you.

Sellers: Slightly lower rates that are starting to stabilize are encouraging more buyers to move forward with their plans. That’s good for demand when you’re planning to sell your house.

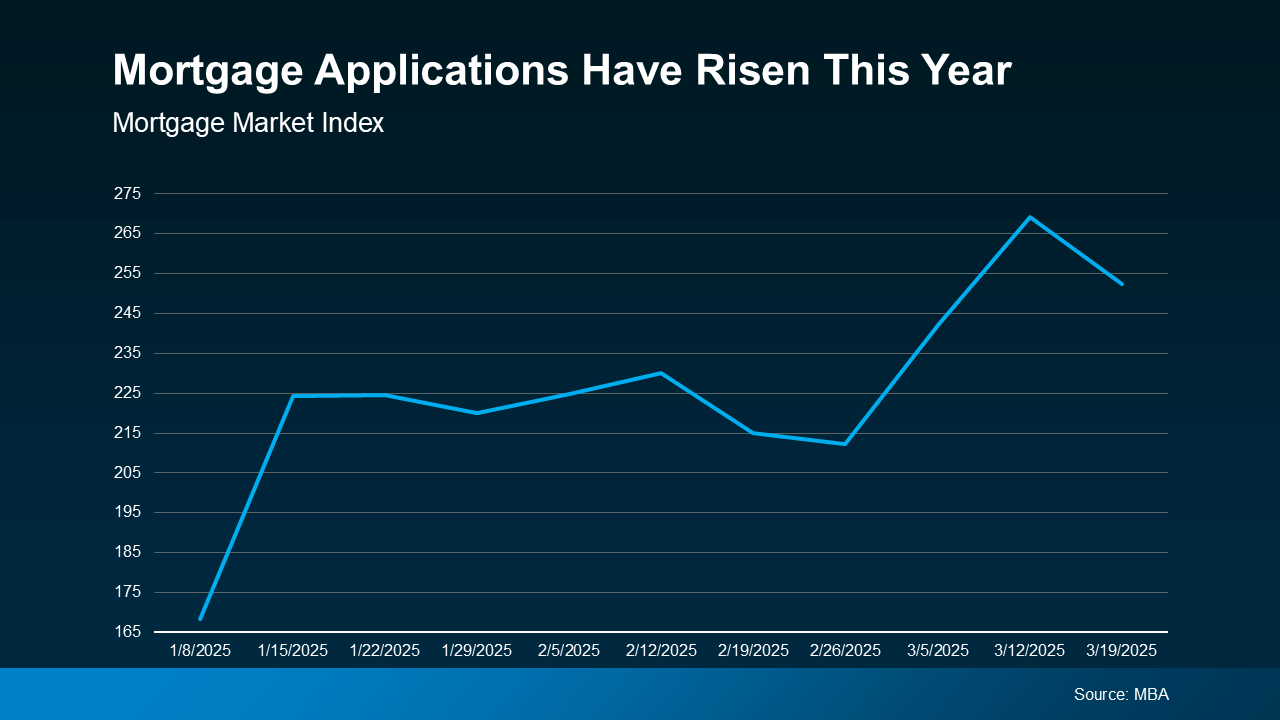

4. More Buyers Are Returning

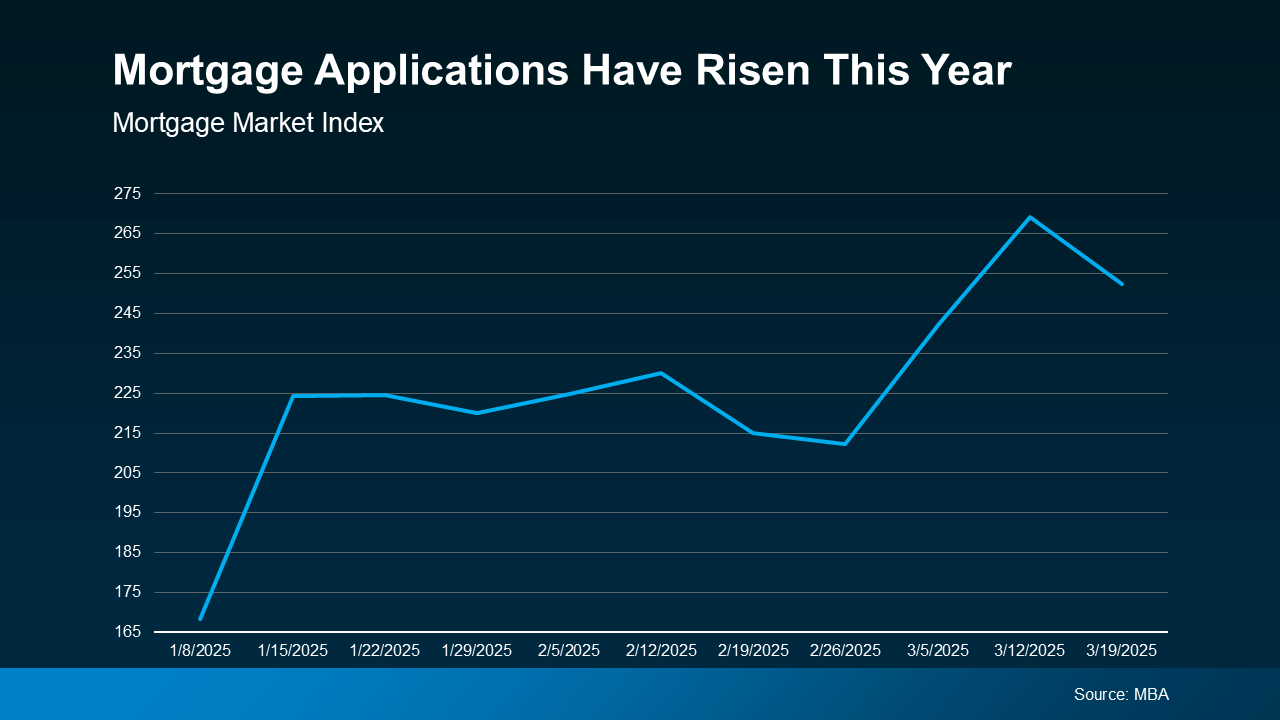

With more inventory, slowing price growth, and stabilizing mortgage rates, buyers are gaining confidence and coming back into the market. Demand is picking up, and data from the Mortgage Bankers Association (MBA) shows an increase in mortgage applications compared to the start of the year (see graph below):

Buyers: Acting sooner rather than later could be a smart move before your competition heats up even more.

Buyers: Acting sooner rather than later could be a smart move before your competition heats up even more.

Sellers: This is great news for you – more buyers mean a better chance of selling your house quickly.

Bottom Line

Do you have questions about what the spring market means for you? Connect with a local real estate agent and talk about how to craft your plan this season.

With more homes for sale, slowing price growth, and stabilizing mortgage rates, how will this impact your decision to buy or sell this spring?

Buyers: This means you have more choices, and you can be more selective.

Buyers: This means you have more choices, and you can be more selective. Buyers: Acting sooner rather than later could be a smart move before your competition heats up even more.

Buyers: Acting sooner rather than later could be a smart move before your competition heats up even more.

The second map shows that, over a roughly 30-year span, home prices appreciated by an average of more than 320% nationally.

The second map shows that, over a roughly 30-year span, home prices appreciated by an average of more than 320% nationally.