Some Highlights

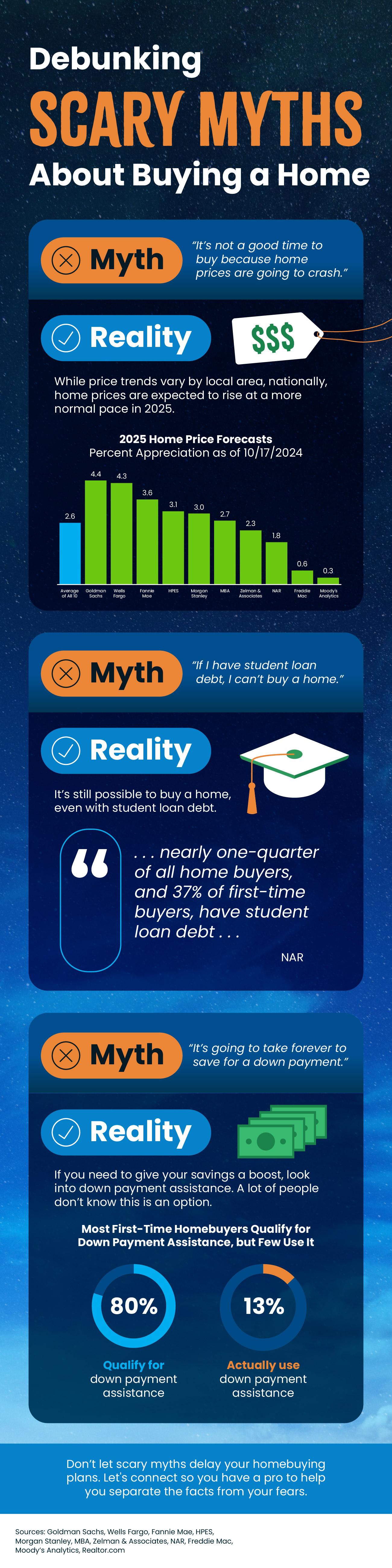

- There are a number of scary myths about homebuying in today’s market. Here’s what you need to know.

- Prices are not expected to crash, it is possible to buy even with student loan debt, and there are programs that can help you save for a down payment.

- Don’t let scary myths delay your homebuying plans. Connect with an agent so you have a pro to help you separate the facts from your fears.