If you’ve owned your house for at least a couple of years, there’s something you’re going to want to know more about – and that’s home equity. If you’re not familiar with that term, Freddie Mac defines it like this:

“. . . your home’s equity is the difference between how much your home is worth and how much you owe on your mortgage.”

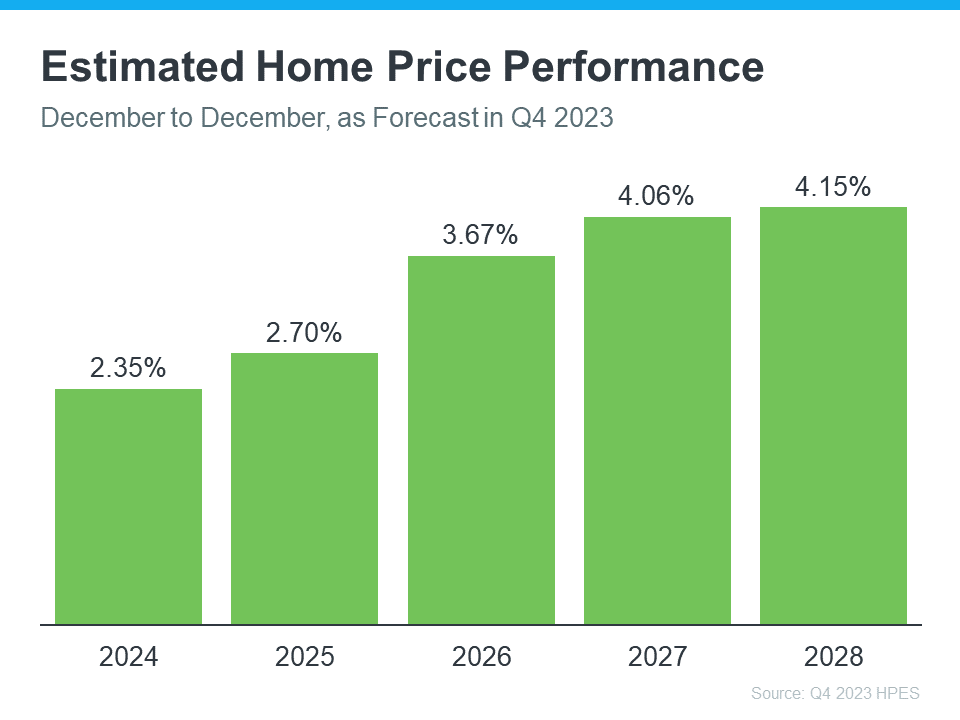

That means your equity grows as you pay down your home loan over time and as home values climb. While it’s true home prices dipped slightly last year, they rebounded and have been climbing in many areas since then. Here’s why that price growth is good news for you.

In the latest Equity Insights Report, Selma Hepp, Chief Economist at CoreLogic, explains:

“With price gains continuing to help homeowners build wealth, equity has reached a new high and regained losses that resulted from declines last year. And while the average U.S. homeowner gained over $20,000 in additional equity compared with the third quarter of 2022, some markets are seeing larger increases as price growth catches up.”

And that figure is just for the last year. To help you really understand how that number can add up over time, the report also says the average homeowner with a mortgage has more than $300,000 in equity. That much equity can have a big impact.

Here are a few examples of how you can put your home equity to work for you.

1. Buy a Home That Fits Your Needs

If your current space no longer meets your needs, it might be time to think about moving to a bigger home. And if you’ve got too much space, downsizing to a smaller one could be just right. Either way, you can put your equity toward a down payment on something that fits your changing lifestyle.

2. Reinvest in Your Current Home

And, if you’re not ready to move just yet, you can use the equity you have to improve your current home. But it’s important to consider the long-term benefits certain upgrades can bring to your home’s value. A real estate agent is a great resource on which projects to prioritize to get the greatest return on your investment when you sell later on.

3. Pursue Personal Ambitions

Home equity can also serve as a catalyst for realizing your life-long dreams. That could mean investing in a new business venture, retirement, or funding an education. While you shouldn’t use your equity for unnecessary spending, using it responsibly for something meaningful and impactful can really make a difference in your life.

4. Understand Your Options to Avoid Foreclosure

While the number of foreclosure filings remains below the norm, there are still some homeowners who go into foreclosure each year. If you’re in a tough spot financially, having a clear understanding of your options can help. Equity can act as a cushion if you’re not able to make your mortgage payments on time.

Bottom Line

If you want to know how much equity you have in your home, connect with a local real estate agent. They can do a professional equity assessment report on how much you’ve built up over time and talk you through how you can use it to help you reach your goals.