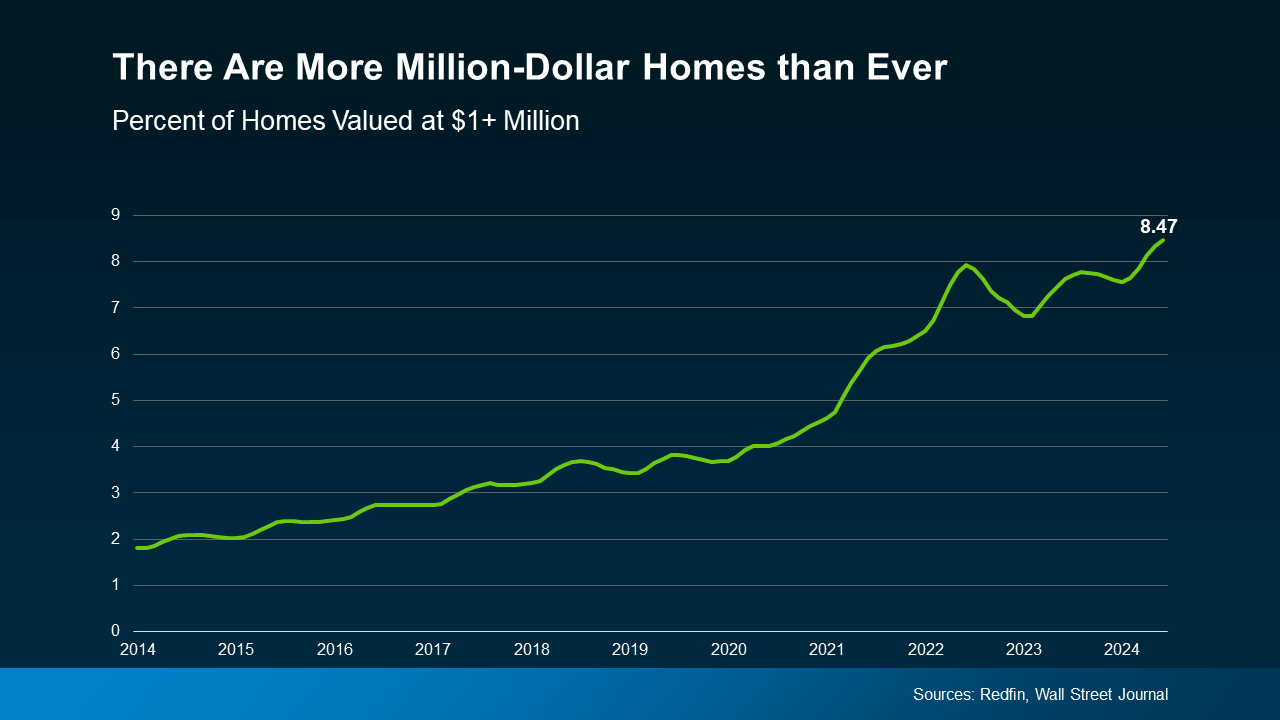

Homeowners typically slow down their moving plans as the summer months wrap up, and as a result, fewer homes are listed for sale in the fall. It’s a predictable, seasonal trend in real estate. But this year, mortgage rates came down at the same time the number of homes on the market usually starts to decline. So, what happened? More homeowners decided to sell, so more homes came to the market.

The most recent data from Realtor.com reveals that in September, the number of homes put up for sale increased by 11.6% compared to this time last year.

As the green circle in the graph below shows, the typical September decline in homes coming to the market didn’t happen – that number actually went up (see graph below):

Ralph McLaughlin, Senior Economist at Realtor.com, explains why there was an unseasonable rise:

Ralph McLaughlin, Senior Economist at Realtor.com, explains why there was an unseasonable rise:

“This sharp increase is largely due to the decline in mortgage rates in mid-August, enticing homeowners to sell.”

So, as rates came down at the end of the summer, more people jumped into the market and decided to make their move.

What Does This Mean If You’re Looking To Buy a Home?

It means more fresh options to choose from than you’ve had in a while – not the ones that have been sitting around, unsold.

But keep in mind, mortgage rates have been volatile lately, ticking up slightly in recent weeks, which could limit the number of people who feel comfortable with the idea of selling in the months ahead. And in this market, it’s mortgage rates that are largely driving homeowner decisions.

Why Buy Now, Rather Than Wait?

Whether you’re looking for a starter home, an upgrade, or hoping to downsize, you have more homes to choose from right now. And if you can find what you’re looking for, know that these new, fresh options won’t be on the market forever. So, staying on top of what’s available in your local area with a trusted agent is key.

And remember, one month doesn’t make a trend. So, what does that mean going forward? Whether more homeowners than normal continue to put their houses on the market will largely depend on what happens with mortgage rates and the economic factors that impact them, like inflation, employment, and the reactions by the Federal Reserve.

With that in mind, now might be your moment, while more homes are available – if you’re ready, willing, and able to buy this fall.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“The rise in inventory – and, more technically, the accompanying months’ supply – implies home buyers are in a much-improved position to find the right home and at more favorable prices.”

Bottom Line

As rates came down at the end of the summer, sellers started to trickle back into the market, which means buyers have more choices right now. And working with a trusted local real estate agent is the best way to take advantage of your new options before they’re all scooped up.