With the cost of just about everything going up these days — groceries, gas and utilities — you might be feeling like now just isn’t the time to take on any home projects. But remember, you don’t need to tackle a full-on renovation to make a big impact.

And if you don’t know where to start or what’s worth doing, lean on your trusted REMAX® agent for advice before you get your projects started.

Sometimes, small weekend projects still pack a big punch.

Here are a few examples of smart, budget-friendly updates you can do in just a few days to not only make your home feel fresh and new, but add value too.

One key place a lot of homeowners want to give some love? The kitchen. But instead of gutting the entire thing, think about smaller ways to give your space a facelift. You could go for new hardware, or maybe even add a backsplash. And if you want a refresh on your cabinets, consider bringing in a pro to paint or re-finish them. Just remember, the right tools are essential to a quality end product. Your REMAX agent can recommend local pros they trust, if you do need to hire someone to get the job done.

Another easy win? Light fixtures. This is one of the most overlooked updates, and one of the most affordable. Switch out that builder-grade fixture in your dining room or hallway for something a bit more modern or with a spark of personality. That’s an easy win to instantly change the feel of a room. And it doesn’t have to cost more than a nice dinner out.

Strategic bathroom refreshes are another great bang-for-your-buck project. You’ll be surprised the difference a new faucet, mirror or shower curtain can make. Add some fluffy towels and a plant or two, and suddenly you’ve got spa vibes on a shoestring budget.

Wallpaper is also having a moment right now — and is pretty affordable. Whether it’s the traditional variety or the peel-and-stick kind, a pattern can add interest and depth to a room. Just don’t overdo it. Sometimes too much can be overpowering.

And don’t underestimate the power of paint. A fresh, neutral coat on the walls can do wonders, especially if your current colors are looking a little tired or too specific. The right shade can brighten a room, make it feel bigger and create a clean, updated look.

The key is playing it smart with your budget.

None of these projects require a ton of time or a huge payout. You may not even need to hire a contractor. Focus on the little upgrades that make a big visual impact, because even in a time when everything feels more expensive, you still deserve to love your home.

This weekend, grab a coffee, throw on some music and knock out one small project. Your home (and future self) will thank you.

Bottom Line

When everything feels more expensive, it’s smart to focus on small updates that make a big impact. You don’t need a huge budget to love where you live. You just need a few good ideas (and maybe a little encouragement).

What’s on your weekend project list? If you’re ready to tackle those small-but-mighty upgrades, your trusted REMAX agent can help you prioritize what adds the most value. You don’t have to spend a fortune to make an impact.

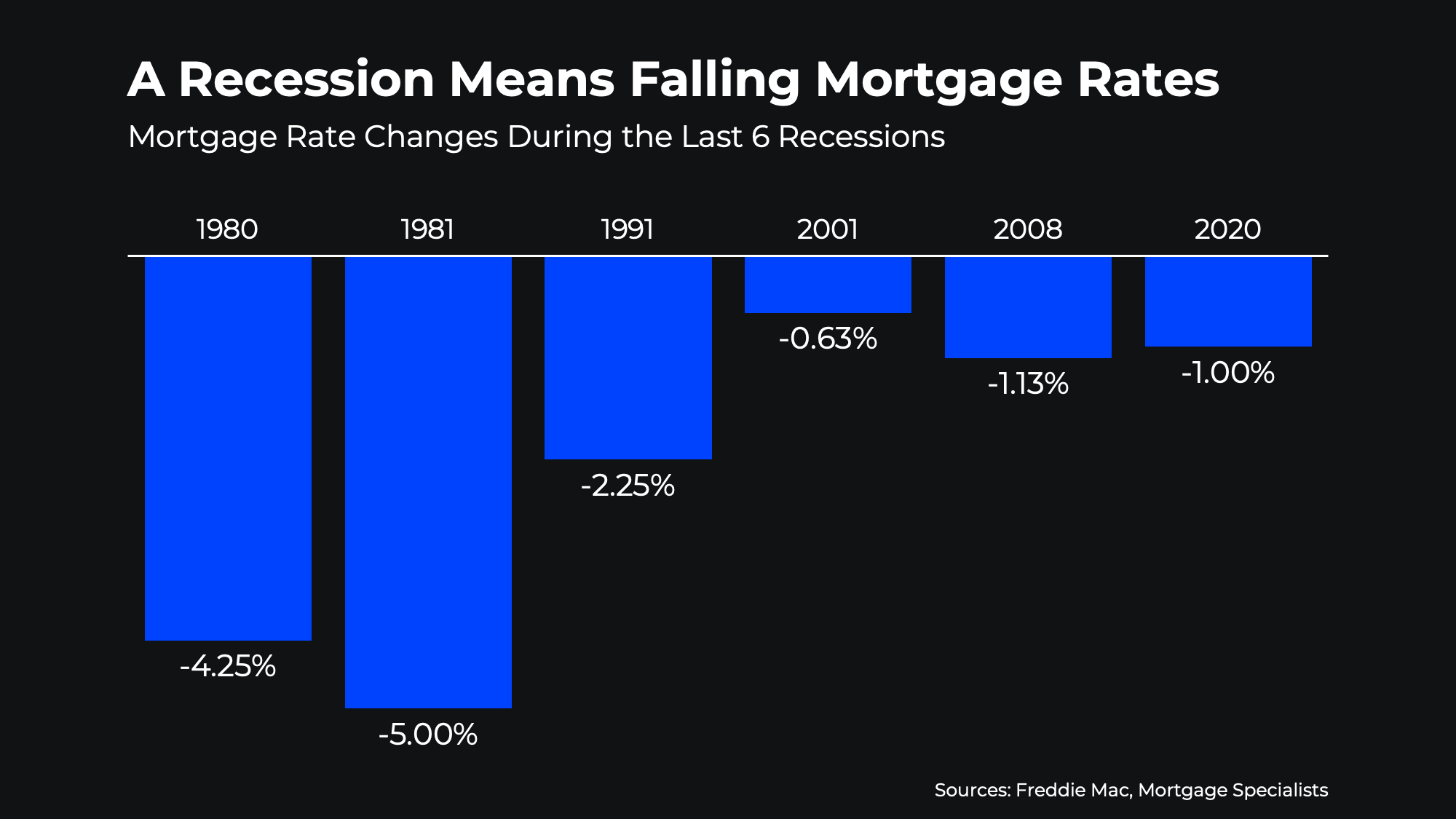

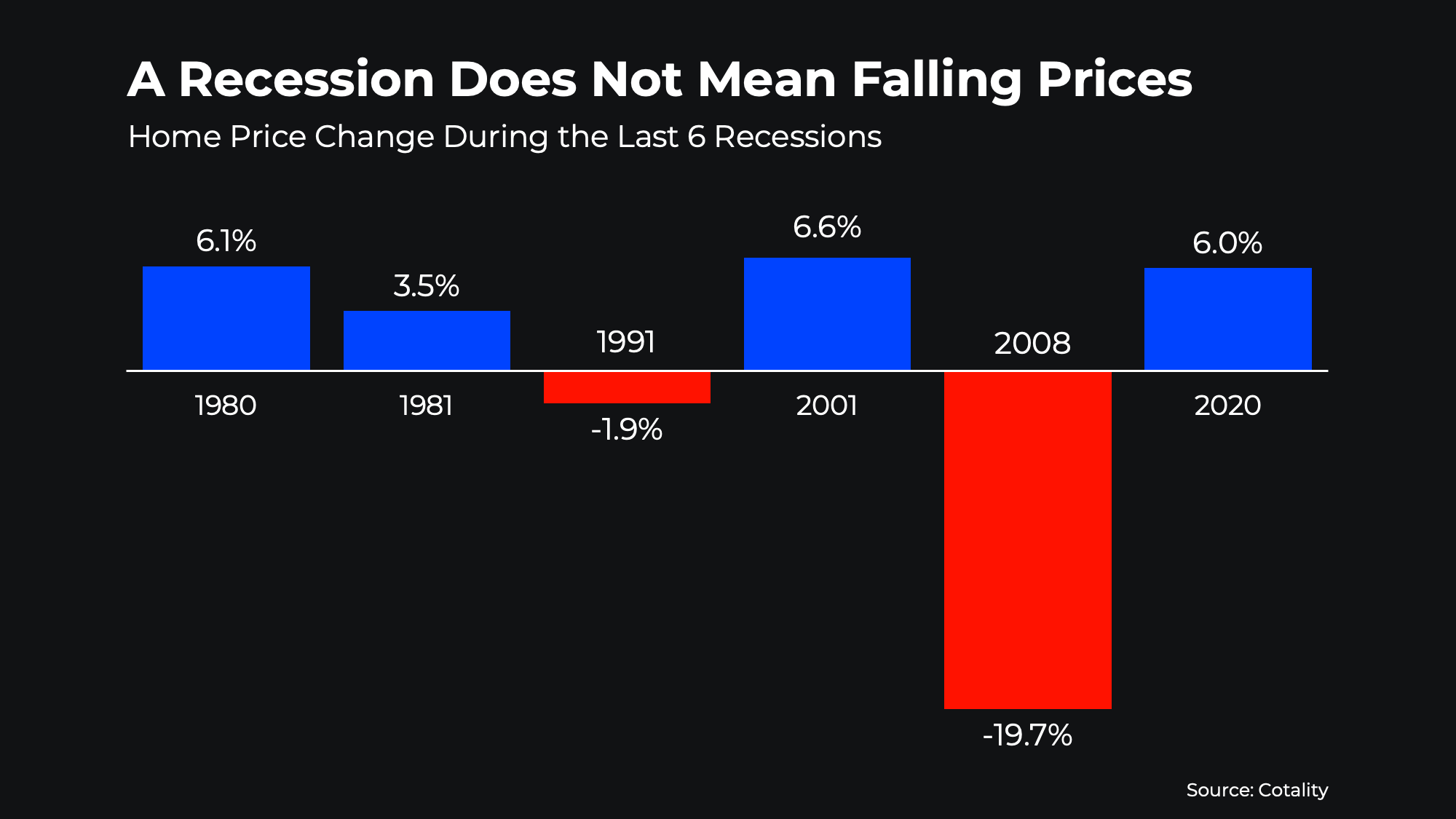

Don’t let fear of a recession make you assume prices are about to fall dramatically.

Don’t let fear of a recession make you assume prices are about to fall dramatically.