June is a busy month in the housing market because a lot of people buy and sell this time of year. So, if you’ve got a move on your mind and you’re looking to make it happen this month, here’s a snapshot of what you need to know to make sure you’re ready.

If You’re Buying This June

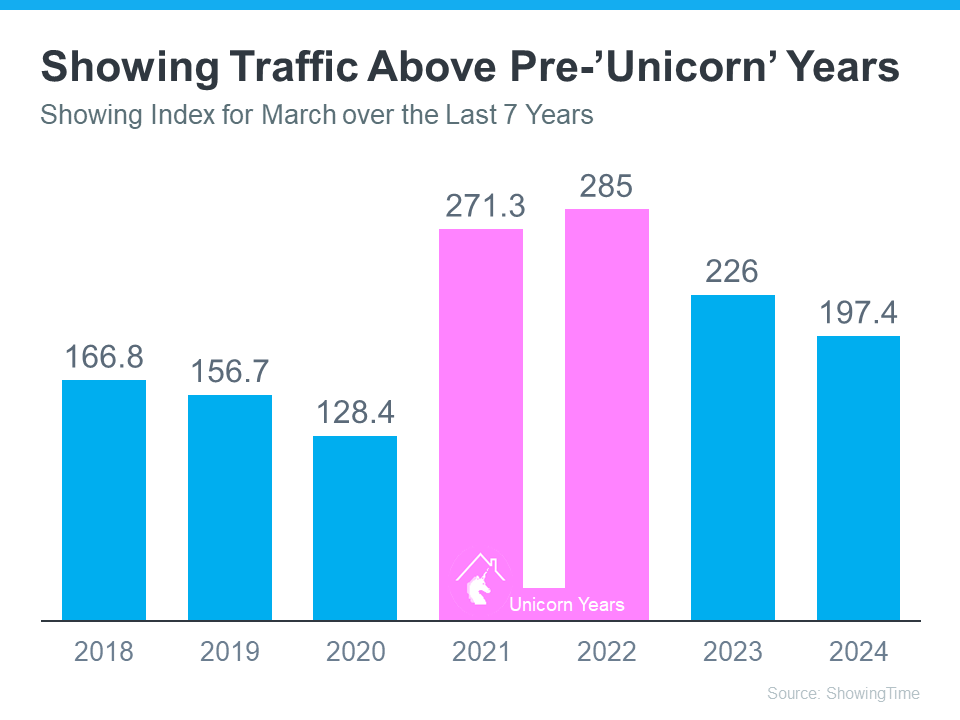

A lot of homebuyers with children like to move after one school year ends and before the next one begins. That’s one reason why late spring into summer is a popular time for homes to change hands. And whether that’s a motivator for you or not, it’s important to realize more buyers are going to be looking right now – and that means you’ll want to be ready for a bit more competition. But there is a silver lining to a move this time of year. This is also when more sellers will list – so you should find you have more options. As an article from Bankrate says:

“Late spring and early summer are the busiest and most competitive time of year for the real estate market. There’s usually more inventory listed for sale than other times of year . . . This is a double-edged sword for a buyer, as you will be met with more opportunities but [also] much more competition.”

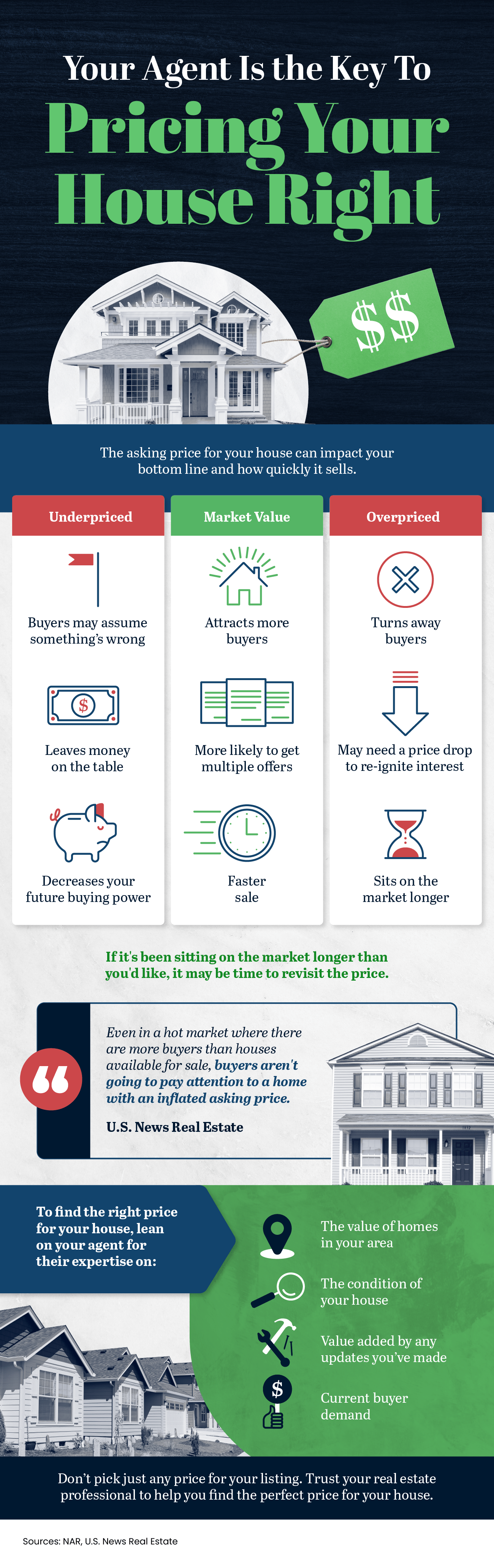

During this busy season, it’s extra important to work with a trusted real estate agent. Your agent will help you stay on top of the latest listings, share expertise on how to make a strong offer in a competitive market, and give you insight into things like what the home is actually worth so you can make an informed decision when you buy. As Forbes says:

“Approaching the market confidently, armed with good information and grounded expectations will take you far. Don’t let the hustle of the market convince you to buy something that’s not in your budget, or not right for your lifestyle.”

If You’re Selling This June

Because there are more buyers this time of year, you’re in a great spot as a seller. Many of those buyers are highly motivated to make their move happen before the next school year kicks off – so they’ll likely put in strong offers to try to make that possible. That means, if your house shows well and is listed at market value, you could see your house sell faster or for a higher price. According to the National Association of Realtors (NAR):

“Warmer weather and the end of the school year encourage more people to buy and sell, respectively. Buyers are looking to move and settle before the new school year begins, contributing to increased competition and, consequently, higher prices.”

You want to be sure you’ve got a great agent on your side to help you with the contingencies on those offers and any negotiations that take place so you can pick the best offer. Make sure you go over closing dates with your agent. Buyers trying to time their move with the school year may need to delay a bit or move faster. This can depend on the school calendar where you live. As U.S. News Real Estate explains:

“ . . if your house goes under contract in early summer, the buyer may ask for a delay in closing or move-in until the school year finishes or their current home has sold. Alternatively, a buyer later in summer may be looking to close quickly and move in under a month. Remain flexible to keep the deal running smoothly, and your buyer may be willing to throw in concessions, like covering some of your closing costs or overlooking the old roof.”

Bottom Line

If you’re looking to make a move this June, chat with a real estate agent so you know what to expect and how to plan for current market conditions.