Your Real Estate Market Update From your Reid Realtors team

We’re about a month into summer break and we are feeling the heat. Not only the weather but the market has picked up. Still, there are some common themes, challenges and opportunities we want you to know about.

Here’s a few highlights:

- The market overall is becoming a healthier and more stable market with home prices correcting themselves from historic highs following the pandemic.

- Homes are selling but with affordability still being a top concern for buyers, homes are selling at a more conservative price point and buyers have higher expectations on move-in ready homes.

- Buyers still have leverage with a smaller pool of buyers in the current market and homes sitting on the market longer.

Let’s dive into more numbers and insights below.

The Numbers

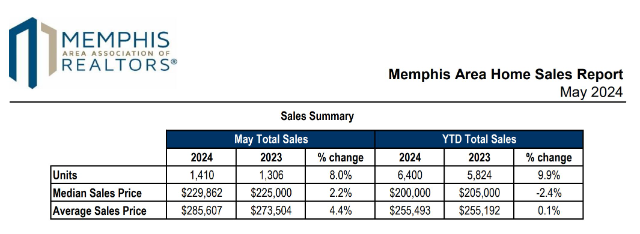

Below highlights overall themes and trends based on the Greater Memphis Area. For information by suburb, click the link below to see your area specifically.

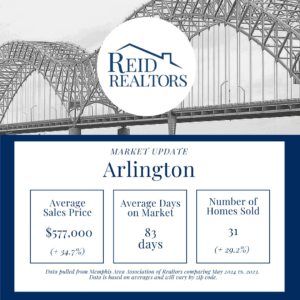

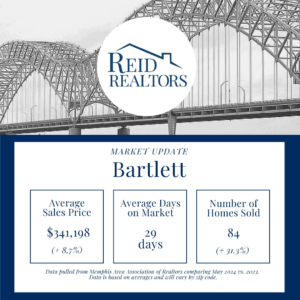

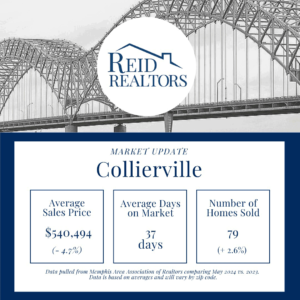

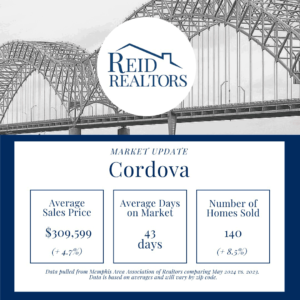

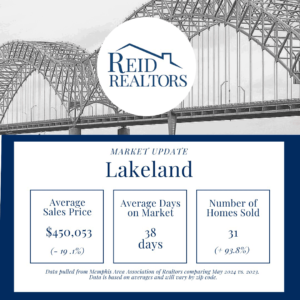

Numbers by Market:

When comparing data Year over Year, you can see that there has been increase in homes (units) sold – up 8% in May and up 9.9% year to date. Average Sales Price in May is slightly up 4.5% but year to date is around the same YOY with just a .1% increase. As you’ll also see in our detailed report on our website, some markets are seeing average sales price remain the same or dip below years past.

We are in a healthier market.

Should home owners be concerned when seeing home values starting to normalize or the pace of growth slow down? Our short answer is no.

Real Estate has always been a longevity investment. Since 2020, the real estate market has experienced unprecedented growth and a growth rate that was not sustainable. Buying at the high end of the market in years past means weighing your options now on what renovations will or will not impact your long term ROI (return on investment), and understanding your 3-5 year real estate goals. In many cases, we see younger families moving more but it may be wise to wait for your home to appreciate in value over the next few years.

However, we understand that life happens. Dreams don’t wait and moving needs or desires may find you moving sooner than you expected. And in this case as a seller in this market, here’s more on what you can expect.

Pricing & staging is crucial for sellers.

If you’re considering listing your home in this market, it is now crucial to price your home correctly. Most homes that hit the market see the most activity within the first two weeks of the home being listed. If you home is overpriced, buyers will know and you may prevent showings. Conversely, if you do get showings on your home, after consulting with a professional, many buyers will not be willing to pay over market value in this market.

Once you know your home is priced correctly, staging plays a major role in getting buyers in the door and under contract. If you are willing to stage, this may also increase your starting price point depending upon any improvements made to the home. Staging can take on a variety of forms from hiring a stager, to decluttering and removing unwanted items and rearranging your items, and of course aesthetic improvements such as painting and landscaping that may be more costly but go along way.

It’s important to talk through your options with your agent to see what’s the best fit for your home and with your timeline and resources.

Pricing and staging will drive demand for your home.

Buyers have leverage.

It is certainly still a buyers market. This means that with such a small pool of buyers due to interest rates, buyers have the advantage of taking their time, waiting on the right home and taking advantage of home sitting on the market longer.

It also means buyers can be more selective, ask for repairs, and have more negotiation power on price.

There are currently 3,128 units available with an average sales price at $410,859 indicating we have a wide range of inventory in the Memphis market at both lower and higher price points. If you’d like to jump into the market, contact us and we’d be happy to help you navigate the ever-changing market.